Gross Salary Meaning In Company

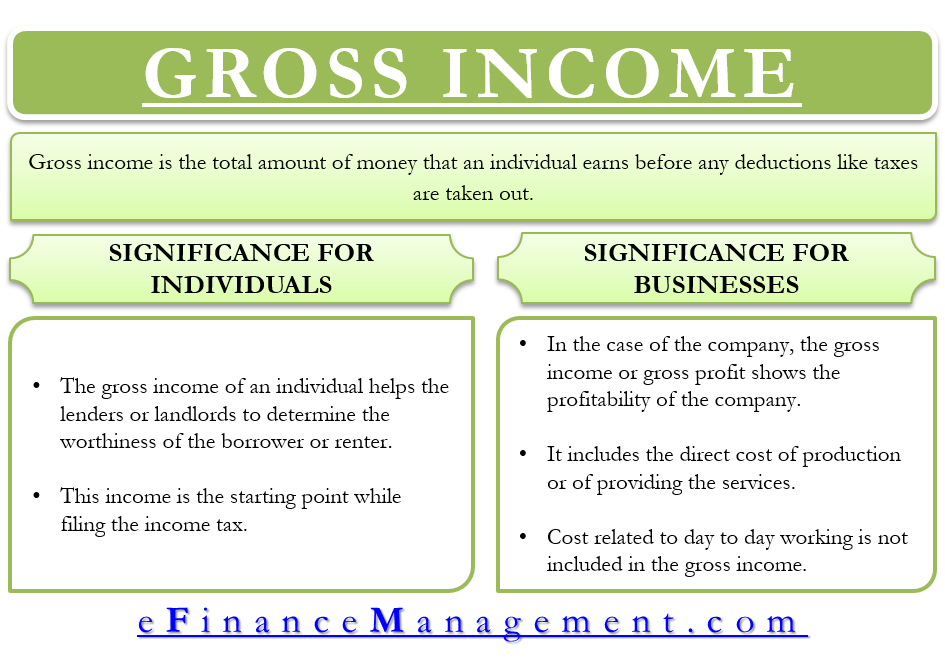

A gross salary is a gratuity and EPF employee provident fund subtracted from the cost to the company. It includes all the allowances and perquisites provided by the employer.

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

It is the gross monthly or annual sum earned by the employee.

Gross salary meaning in company. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted. In literal terms Gross Salary is the monthly or yearly salary before any deductions are made from it. The gross salary is mentioned in the companys offer letter in the compensation or salary section which mainly enlist all the components of the pay package.

The total cost that a company would incur on an employee in a year. What is Gross Salary. As basic salary is 10K the employer has to additionally contribute 12 of basic salary into provident fund PF.

Gross Salary is employee provident fund EPF and gratuity subtracted from the Cost to Company CTC. Say an employee has a gross salary of 20K basic salary of 10K and 10K other incentives 20K annual variable pay. All Your Salary Components Decoded.

To put it in simpler terms Gross Salary is the amount paid before deduction of taxes or other deductions and is inclusive of bonuses over-time pay holiday pay and other differentials. Gross salary also called Cost to Company CTC is the total amount of salary that an employer pays an employee. For example when an employer pays you an annual salary of 50000 per year this means you have earned 50000 in gross pay.

Clearly identify what your gross salary is the salary before your deductions and tax. The CTC package shows a detailed break-up showing basic salary HRA House rent. Gross rate of pay is your basic rate of pay plus allowances.

Gross Salary is employee provident fund EPF and gratuity subtracted from the Cost to Company CTC. It is therefore imperative to discuss your salary package at the outset. Guaranteed 13 th cheque.

This means your gross salary plus the employers contributions. Your basic cash salary gross salary is the actual salary you receive for rendering your services to the company - bear in mind that is amount is taxable. The gross salary denotes the maximum compensation that the employer pays to each of its employees.

Your net salary is derived after your portion of the deductions are removed from your gross salary. The gross salary before income tax and other deductions is what is listed as Cost To Company salary for a period of 12 months in a financial year. Per month salary and other benefits that the company pays an employee are actually cost to the company.

This total income is usually described as an annual salary and it is the total amount an employee will receive for work completed before tax or national contributions are deducted. What is CTC package. It includes bonuses over-time pay holiday pay and other differentials.

Gross salary is the salary which a company is providing on a monthly basis. Gross Salary is the sum total of all the components of your compensationsalary package. The meaning of gross salary is the total income before any deductions are removed from that amount.

Gross Salary Basic Salary HRA. The components of Gross salary consists of the following. Gross pay refers to the amount used to calculate the wages of an employee hourly or salary for the salaried employee.

To put it in simpler terms Gross Salary is the amount paid before deduction of taxes or other deductions and is inclusive of bonuses over-time pay holiday pay and other differentials. Gross salary is basically the salary which is without any deductions like income tax PF medial insurance etc.

Gross salary is the amount paid to an employee before deducting his taxes and after subtracting the amounts paid in EPF gratuity bonus holiday pay over-time pay and other variants. Gross pay is the total amount of money an employee receives before taxes and deductions are taken out. CTC package is a term often used by private sector Indian companies while making an offer of employment.

Basic Salary कस कमपन य नयकत दवर करमचर क दय गय वह वतन दर ह जसम ओवरटइम य कस भ अनय परकर क अतरकत कषतपरत रश शमल नह ह. Gross salary is the amount calculated by adding up ones basic salary and allowances before deduction of taxes and other deductions. It is the total amount of remuneration before removing taxes and other deductions such as Medicare social security insurance and contributions to pension and charity.

The companys contribution such as.

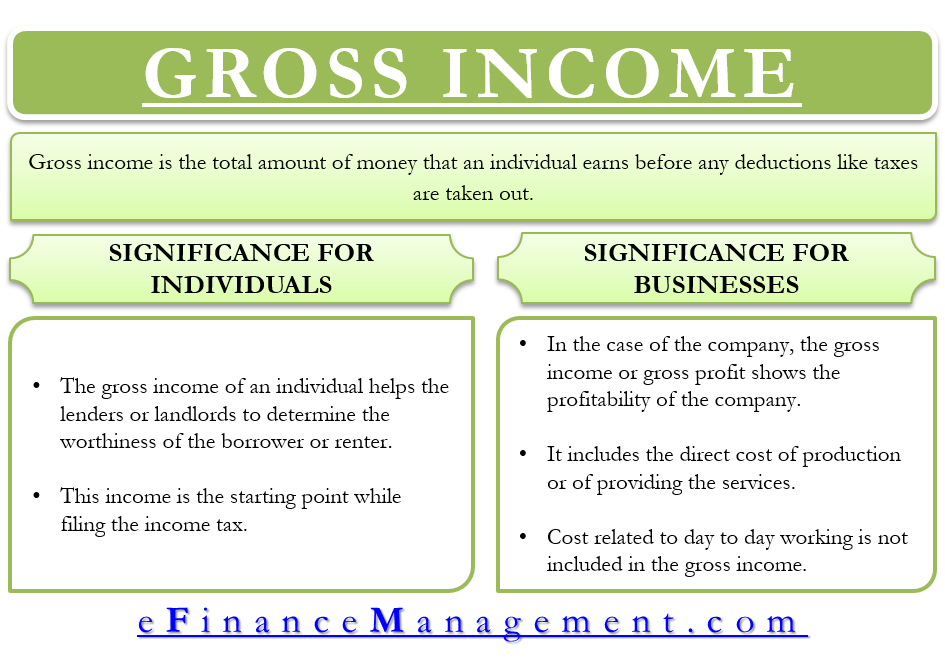

What Is Gross Income For A Business

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Concept With Examples Efinancemanagement

Gross Salary Definition Importance Example Human Resources Hr Dictionary Mba Skool Study Learn Share

What Is Base Salary Definition And Ways To Determine It Snov Io

Salary Formula Calculate Salary Calculator Excel Template

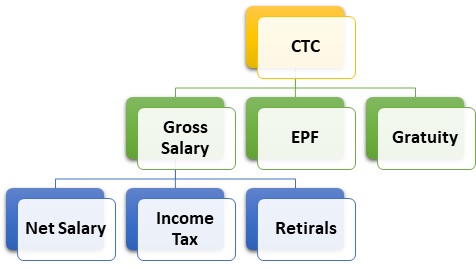

Gross Vs Net Income Importance Differences And More In 2021 Bookkeeping Business Accounting And Finance Finance Investing

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

What Is Ctc Salary Why We Get Less Salary Than Quoted

Salary Net Salary Gross Salary Cost To Company What Is The Difference

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary Formula Calculate Salary Calculator Excel Template

Gross Salary Vs Net Salary Top 6 Differences With Infographics

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Difference Between Ctc Gross Salary And Net Salary

Difference Between Gross Income Vs Net Income Definitions Importance

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Post a Comment for "Gross Salary Meaning In Company"