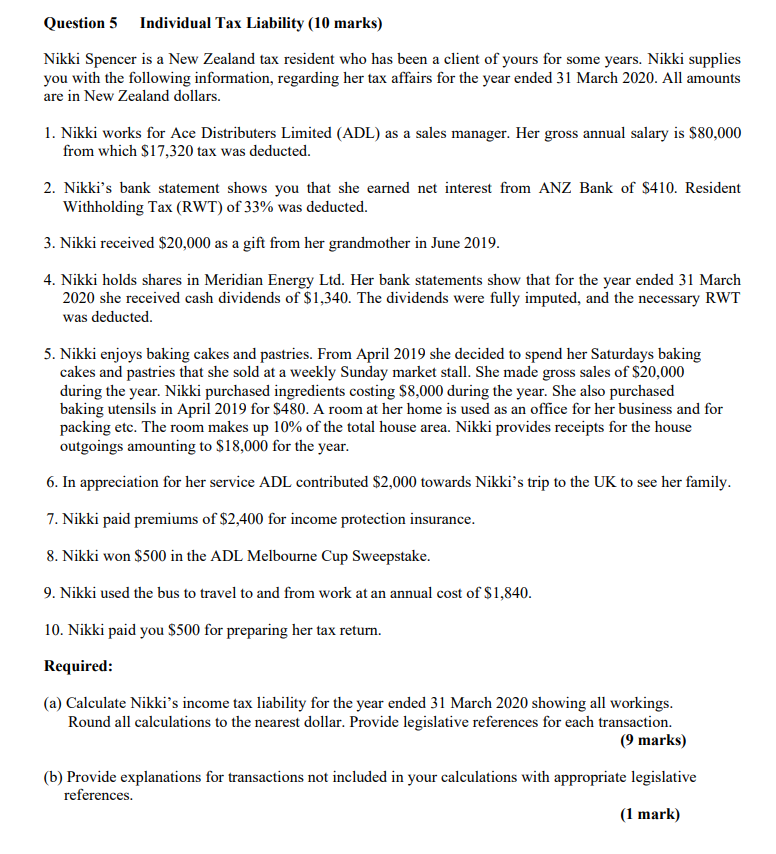

Tax On Annual Income Calculator New Zealand

Calculate you Annual salary after tax using the online New Zealand Tax Calculator updated with the 2020 income tax rates in New Zealand. It will not include any tax credits you may be entitled to for example the independent earner tax credit IETC.

Frankly My Dear Tax Prep Budget Goals Estimate Template

The calculator is designed to be used online with mobile desktop and tablet devices.

Tax on annual income calculator new zealand. That means that your net pay will be 56931 per year or 4744 per month. Use our tax code finder and tax on annual income calculator. End of tax year Were sending income tax assessments out from late-May until the end of July.

Income Tax Calculator For calculating New Zealand income tax This income tax calculator estimates annual income tax for income received after 1 April 2021 by first calculating your profit the tax amount in each tax bracket and total income tax for the year. To use the PAYE calculator enter your annual salary or the one you would like in the Insert Income box below. Calculate your take home pay KiwiSaver Student Loan Secondary Tax Tax Code.

New Zealand has progressive or gradual tax rates. This income tax calculator will allow you to quickly and easily see your tax or government deductions based on your salary. Calculate your income tax social security and pension deductions in seconds.

You pay tax on this income at the end of the tax year. Working for families work and. Which tax rates apply.

One of a suite of free online calculators provided by the team at iCalculator. If you are looking to find out your take-home pay from your salary we recommend using our Pay. This is the amount of salary you are paid.

Calculate your tax and kiwisaver payments salaries. Information you need for this calculator. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the New Zealand tax calculator and change the Employment Income and Employment Expenses period.

The Annual Wage Calculator is updated with the latest income tax rates in New Zealand for 2021 and is a great calculator for working out your income tax and salary after tax based on a Annual income. Use this calculator to work out your basic yearly tax for any year from 2011 to 2021. Your average tax rate is 2201 and your marginal tax rate is 3446.

The Annual Wage Calculator is updated with the latest income tax rates in New Zealand for 2019 and is a great calculator for working out your income tax and salary after tax based on a Annual income. The taxes are collected at a national level by the Inland Revenue Department IRD on behalf of the Government of New Zealand. This calculator helps you to calculate the tax you owe on your taxable income for the full income year.

Salary after tax calculator new zealand nz. You can vary the kiwisaver contribution rate to see the effect on your net pay. Calculate you Annual salary after tax using the online New Zealand Tax Calculator updated with the 2016 income tax rates in New Zealand.

Just enter your gross annual salary into the box and click Calculate - then well show you a breakdown of how much PAYE tax youll pay and what your kiwisaver and student loan contributions will be. The table below will automatically display your gross pay taxable amount PAYE tax ACC KiwiSaver and student loan repayments on annual monthly weekly and daily basis. The amount of tax you pay depends on your total income for the tax year.

Foreign investment fund calculator The Foreign investment fund calculator is not working correctly and has been removed from our website. The rates increase as your income increases. Online road user charges ruc calculator ministry of transport.

This marginal tax rate means that your immediate additional income will. From 1 April 2021. What this calculator doesnt cover.

New Zealands Best PAYE Calculator. It can be used for the 201314 to 202021 income years. See how we can help improve your knowledge of Math Physics Tax Engineering and.

See how we can help improve your knowledge of Math Physics Tax Engineering and more. We expect to have it working correctly this week. The income tax in New Zealand starts at 105 for incomes up to 14000 NZD and ends at 39 for wages greater than 180000 NZD.

The calculator is designed to be used online with mobile desktop and tablet devices. Calculate your income tax social security and pension deductions in seconds. It also will not include any tax youve already paid through your salary or.

To use this income tax calculator simply fill in the relevant data within the green box and push Calculate. One of a suite of free online calculators provided by the team at iCalculator. How to use the New Zealand Income Tax Calculator.

This includes income from self-employment or renting out property and some overseas income. Gst calculator new zealand 15. If you make 73000 a year living in New Zealand you will be taxed 16069.

The New Zealand tax calculator assumes this is your annual salary before tax. Income tax calculator kiwitax small business rental property. Tax on annual income calculator by keyword.

Types of individual income Individual income includes salary and wages foreign superannuation and other overseas income voluntary work and individualised funding. Before you use the calculator.

What Is My Personal Tax Residency Tax Residency And Status Tax Deductions Tax Refund Invoice Template

Https Www2 Deloitte Com Content Dam Deloitte Nz Documents Tax Calendars Nz Tax Calendar 2021 2022 V1 Pdf

Tax Manager Average Salary In New Zealand 2021 The Complete Guide

Pin On Mortgage Oayment Calculator

Save Thousands Of Dollars In Taxes With A Student Visa Go Study Australia

The Top 10 Items For Your Annual Financial Checklist Start Up Business Budgeting Financial Checklist

Income Tax Calculator For New Zealand Income Tax Kiwitax

How To Calculate Tax Refund Nz

Nz Income Tax Calculator July 2021 Incomeaftertax Com

How To Calculate Foreigner S Income Tax In China China Admissions

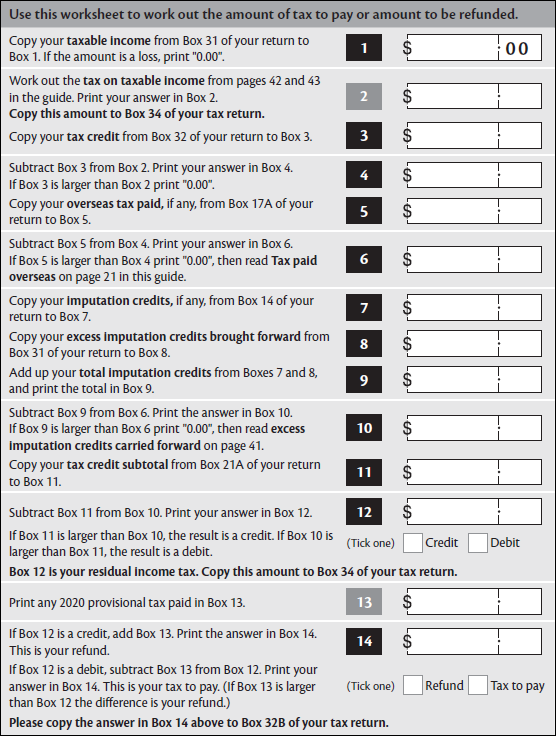

Ir3 Question 34 Tax Calculation Ps Help Tax Nz 2020 Myob Help Centre

Medallia Experience Management Dashboard Customer Experience Experience Management

Budget 2020 New Income Tax Rates New Income Tax Slabs Income Tax Calculation 2020 21 Youtube

What Is Gst Gst Is A Comprehensive Value Added Tax On Goods And Services It Is Collected On Value Added A Goods And Services Study Materials Value Added Tax

Post a Comment for "Tax On Annual Income Calculator New Zealand"