Hourly Salary Law Change

As a result of the change in the minimum wage for 2021 the minimum salary required for the states administrative professional and executive exemptions will increase to 82720 per week or two times the minimum wage for a 40-hour week on January 1 2021. Change From Salary To Hourly Law FLSA Changes.

Hourly Vs Salary Pros And Cons Quill Com Blog

Minimum Salary Requirements for 2021.

Hourly salary law change. Halp April 4 2018 I have to change an employee from salary to hourly. Salary non exempt laws. Minimum salary set at the 40th percentile.

Overtime Rules Change New Overtime Laws Lore Law Firm. Less opportunity may exist for training or advancement. When these transitions happen it can be necessary to change an employees wage from hourly to salary or salary to hourly based on the role that they will be performing.

One important factor to consider is that salaried employees arent eligible for overtime pay as defined by the Fair Labor Standards Act FLSA. With the proposed change that limit will increase to 970 per week or about 51000 per year. A combination of laws and employer policies determine a salaried or hourly classification on a position.

What Determines if an Employee is Salaried or Hourly. This is because as AXCET HR explains the minimum salary that was. A list of job recommendations for the search exempt employee salary law change is provided here.

The Pros and Cons of Transitioning From Hourly to Salary. All details for the classification change should be documented including new FLSA classification as non-exempt type of pay received eg hourly salary piece rate and the. When laws change or the company goes through tough times hourly employees often feel the impact first.

Currently the wage limit is only 455 per week or less than 24000 per year. Highly compensated employee HCE exemption set at 134004 per year. So if youre an hourly employee who is moving to a salaried position its important to consider how this factor may impact your paycheck.

Maryland law for salary employees. If an employer changes the compensation structure from salary payment to hourly payment he must abide by all laws that govern the hourly pay of employees. If laws change or the company has a turbulent time often hourly employees become impacted first as in laid off or fewer hours.

If an employer changes the compensation structure from salary payment to hourly payment he must abide by all laws that govern the hourly pay of employees. If an employer changes the compensation structure from salary payment to hourly payment he must abide by all laws that govern the hourly pay of employeesFor example employers must pay hourly employees a minimum wage and must pay them overtime for each hour that they work over 40 per week at the rate of 1 12 times their. For example employers must pay hourly employees a minimum wage and must pay them overtime for each hour that they work over 40 per week at the rate of 1 12 times their hourly pay.

The Federal and state laws favor paying hourly. The federal overtime pay law has been changed to increase the wage threshold for white collar employees to qualify as salary exemptMinimum salary set at 913 per week or 47476 per year. All of the job seeking job questions and job-related problems can.

She works hard and we are a small practice and gets her work regular done during our office hours which total an actual 355 hours a week. For example an executive at a company may expect to receive a full-time salary rather than. The new overtime law guidelines establish that workers must be in the 40th percentile or above of the average of all salaried workers to qualify for exempt status.

For example employers must pay hourly employees a minimum wage and must pay them overtime for each hour that they work over 40 per week at the rate of 1 12 times their hourly pay. The law governing the change from salary to hourly in 2020 has caused some companies to transition their employees in this manner. The predetermined amount cannot be reduced because of variations in the quality or quantity of the.

Being paid on a salary basis means an employee regularly receives a predetermined amount of compensation each pay period on a weekly or less frequent basis. Its easier for an employer to knock off some of your hours until business improves than. The distinction often becomes based on the kind of work done in a position.

An employer has the right to switch an employee from salary to hourly and re-work your hourly rate unless you are still under an employment contract. Is It Legal to Change From Salary to Hourly Pay. Exempt computer employees may be paid at least 684 on a salary basis or on an hourly basis at a rate not less than 2763 an hour.

Salary Vs Hourly Pay What Are The Differences Indeed Com

German Minimum Hourly Wage Bumped Up For 2017 News Dw 28 06 2016

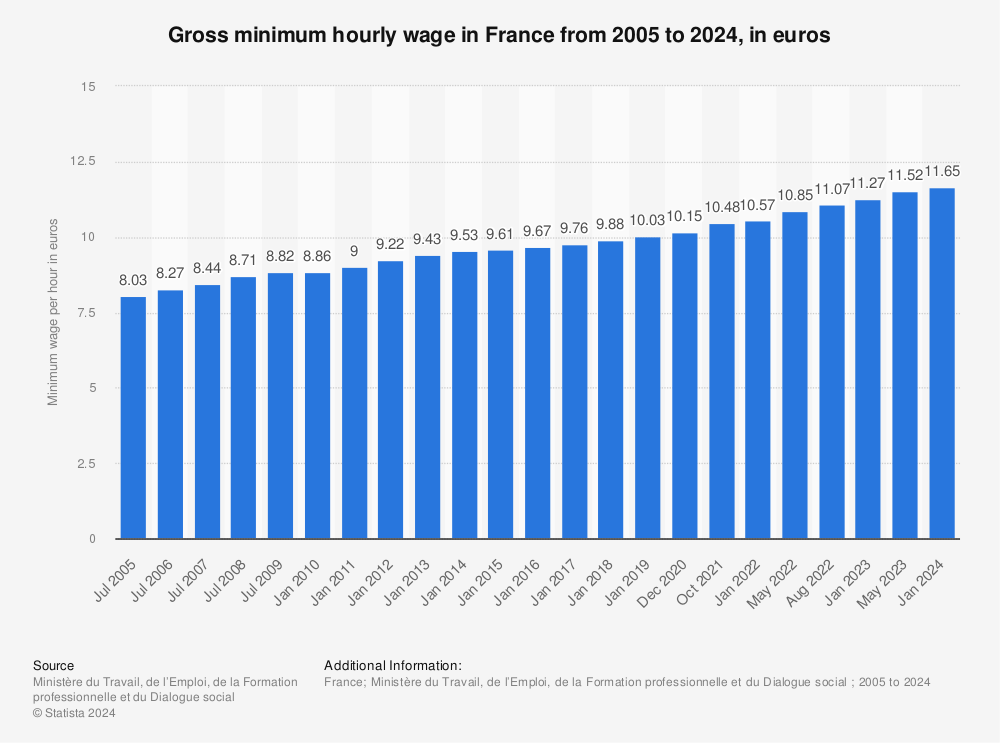

France Gross Minimum Hourly Wage 2005 2019

Dol New Overtime Rule How To Handle The Newly Nonexempt

Korea S 2021 Minimum Wage Set At 7 23 Up 1 5 In Weakest Rise On Record Pulse By Maeil Business News Korea

Flsa Update Department Of Labor Issues Final Rule On Overtime Pay Govdocs

The Effect Of Minimum Wage Increases On Wages Hours Worked And Job Loss Bulletin September Quarter 2018 Rba

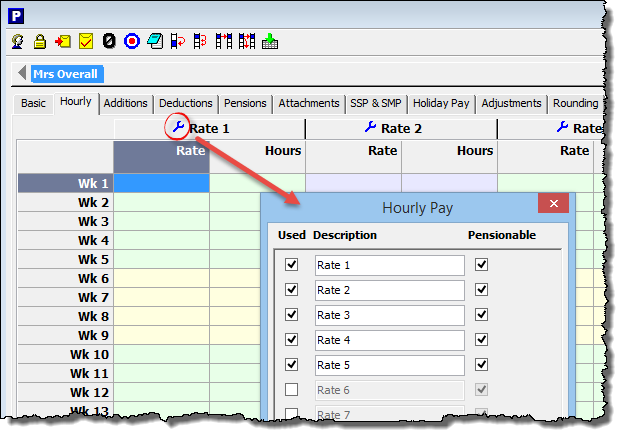

Hourly Pay And Displaying Hours Worked On A Payslip Moneysoft

How To Tell Your Salaried Employees They Are Now Hourly Inc Com

Minimum Wage And Overtime Changes Come With Unintended Consequences The Maine Wire

Explaining National Living Wage National Minimum Wage Rates Increases For 2021 The Legal Partners

French Minimum Wage And Average Salary In France Expatica

How To Switch Employees From Salary To Hourly The Timesheets Com Journal

Average Hourly Wages In Canada Have Barely Budged In 40 Years National Globalnews Ca

Minimum Wage In France In 2021 Fred Payroll

Keep Up To Date This April 6 Key Changes In The World Of Employment Law 2021 Hillyer Mckeown

Hourly Vs Salary Pros And Cons Quill Com Blog

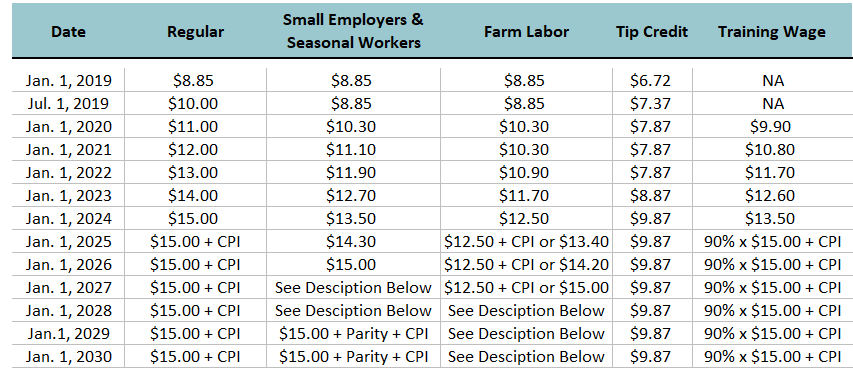

Minimum Wage Law P L 2019 C 32 Njbia New Jersey Business Industry Association

Post a Comment for "Hourly Salary Law Change"