Annual Income Calculator Bc

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. One of a suite of free online calculators provided by the team at iCalculator.

Mathematics For Work And Everyday Life

Why not find your dream salary too.

Annual income calculator bc. There are two ways to determine your yearly net income. Your working time will include days per week hours per day and weeks per year. How annual income is calculated under the Federal Guidelines.

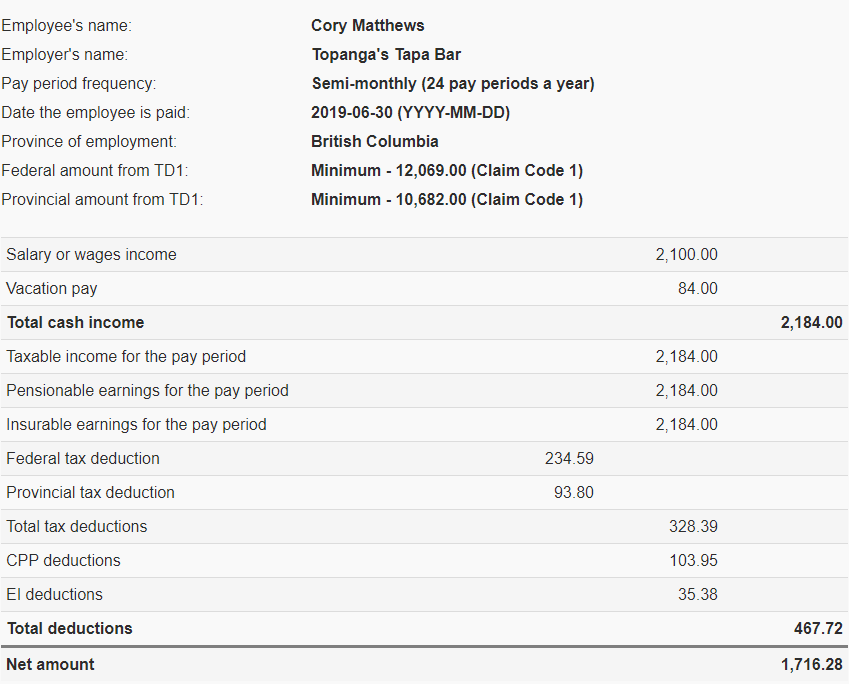

Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location. Youll then get a breakdown of your total tax liability and take-home pay. Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income.

Set the net hourly rate in the net salary section. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. That means that your net pay will be 41196 per year or 3433 per month.

On average the number of weeks worked per year is around 50 weeks. If you make 52000 a year living in the region of British Columbia Canada you will be taxed 10804. This calculator provides an overview of the annual minimum wage for workers in British Columbia BC excluding the compensation of days off and holidays thus the annual hours worked To calculate only the minimum annual salary including holidays simply indicate 0 in the field Holiday Statutory weeks Do you like Calcul Conversion.

Salary Before Tax your total earnings before any taxes have been deducted. Your average tax rate is 208 and your marginal tax rate is 338. As a general rule to calculate income for child support you must identify the updated amounts related to the sources of income used to calculate your Total income on line 15000 150 for 2018 and prior years of the T1 General Form issued by the Canada Revenue Agency.

Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. Need help finding the right home loan. Some money from your salary goes to a pension savings account insurance and other taxes.

How to calculate annual income from hourly. Phone us on 1300 130 987Our team are happy to help put you in touch with a broker local to your areaOnline enquiryComplete our online enquiry form and well give you a call to connect you with one of our brokers. Hourly to salary calculator to calculate your income in hourly weekly bi-weekly semi-monthly monthly quarterly and annually.

Simply enter your annual or monthly income into the tax calculator above to find out how taxes in Canada affect your income. Total Opening Balance. First determine your hourly pay rate and working time.

The other 2 weeks are vacation. Next determine any additional. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Net income is the money after taxation. Formula for calculating net salary in BC Gross annual income Taxes CPP EI Net annual salary Net annual salary Weeks of work year Net weekly income Net weekly income Hours of work week Net hourly wage. Age Year Open Value Gross Payment Withholding Tax Net Payment Total Annual Net Payment Annual Payment Opening Balance.

The Great British class calculator. Also known as Gross Income. 7 lignes Easy income tax calculator for an accurate British Columbia tax return estimate.

Maximum LIF calculations for British Columbia Alberta Manitoba and Ontario are based on the greater of 1 the maximum withdrawal percentage factor and 2 the previous years investment returns. If you have vacation pay for these days enter your weeks as the full 52 weeks. Back to calculators Income annualisation calculator Work out your annual income from the money youve received so far this year.

The latest budget information from April 2021 is used to show you exactly what you need to know. The 2021 British Columbia Tax Calculator provides free online tax calculations for British Columbia province tax and Federal Tax tables in 2021. LIF payments are annual amounts and are made at the start of the year.

How Much do I Make a Year Calculator to convert hourly wage to annual salary. Formula for calculating net salary in BC The annual net income is evaluated by subtracting the amounts related to the tax Canada Tax and British Columbia Tax the Canadian Pension Plan the Employment Insurance. Annual net income calculator.

Find out how much do I make annually now by entering your hourly wage. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Total Annual Net Payment.

Hourly rates weekly pay and bonuses are also catered for. For Manitoba this calculator does not factor in the 6 of the value of transfers from a LIRA or pension plan during the current. The British Columbia Income Tax Salary Calculator is updated 202122 tax year.

Traditional British social divisions of upper middle and working class seem out of date in the 21st Century no longer reflecting modern occupations or lifestyles. BBCs annual income in the United Kingdom UK 2010-2020 by source BBCs spending per service in the United Kingdom UK 2013-2020 BBC digital media spending distribution in. 3600000 salary example for British Columbia in 2021.

Salary After Tax the money you take home after all taxes and contributions have been.

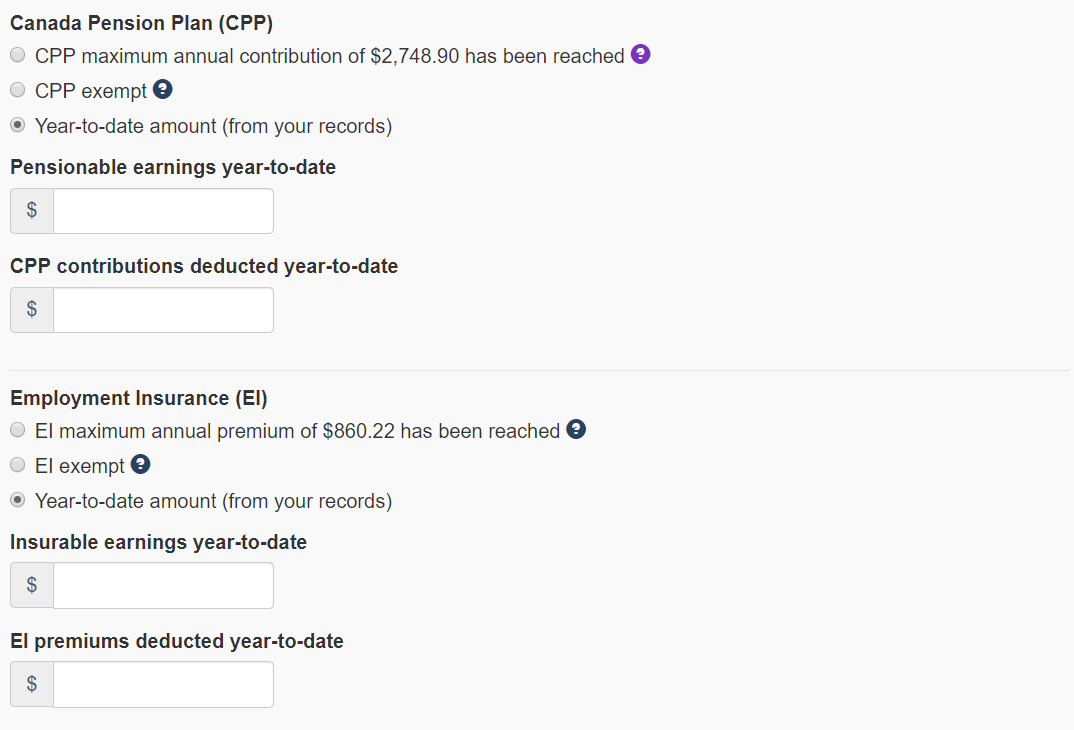

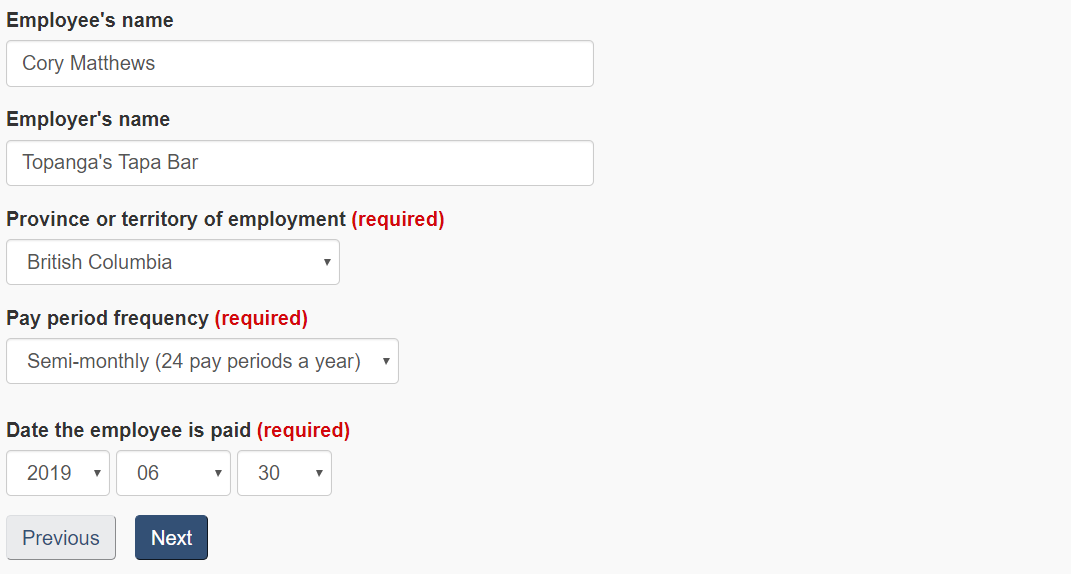

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Annual Income Learn How To Calculate Total Annual Income

Bc Income Tax Calculator Wowa Ca

Average Salary In British Columbia 2021 The Complete Guide

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

Annual Income Learn How To Calculate Total Annual Income

The Salary Calculator Tells Your Yearly Net Income In Vancouver After Income Tax And National Insurance Contributions Have Salary Calculator Salary Net Income

Avanti Gross Salary Calculator

How To Create An Income Tax Calculator In Excel Youtube

How To Use The Cra Payroll Deductions Calculator Avalon Accounting

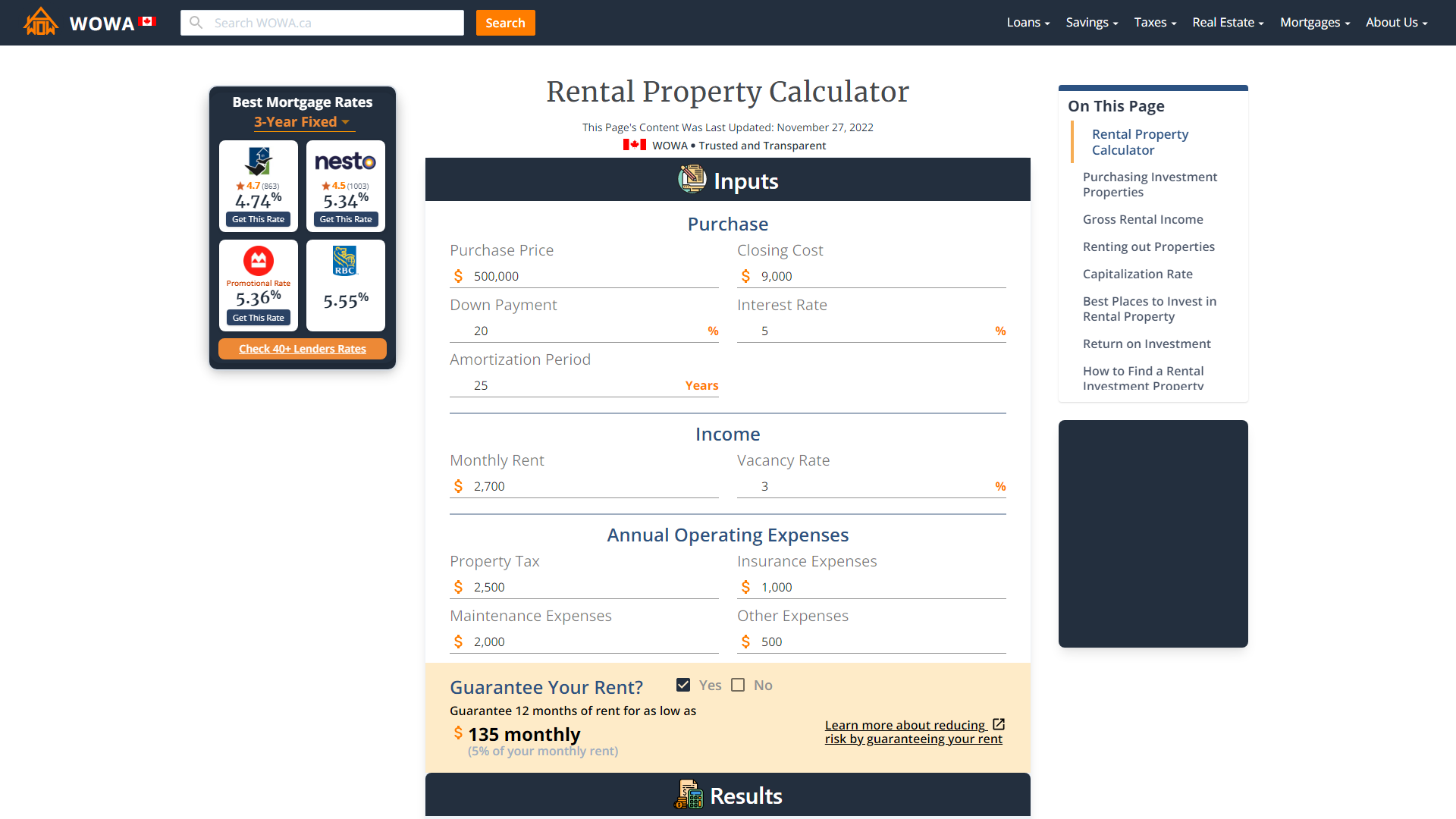

Rental Property Calculator 2021 Wowa Ca

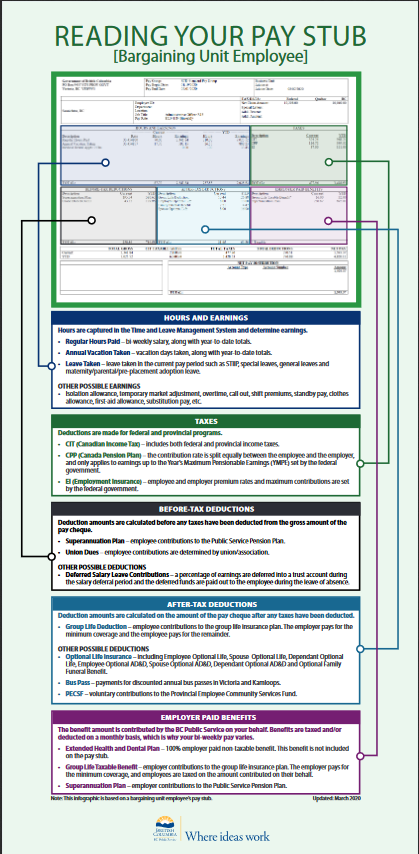

How To Read Your Pay Stub Province Of British Columbia

2021 Salary Calculator Robert Half

Canada S Federal Personal Income Tax Brackets And Tax Rates 2021 Turbotax Canada Tips

Income Tax Formula Excel University

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Excel Formula Income Tax Bracket Calculation Exceljet

Canada Federal And Provincial Income Tax Calculator Wowa Ca

Post a Comment for "Annual Income Calculator Bc"