Annual Income Calculator Alberta

We have used an estimate based on the average in your province. Here are the steps to calculate annual income based.

Use Our Mortgage Planner App That Gets You Access To A Wide Variety Of Premium Tools To Help Plan Your Mortgage H Stress Tests The Borrowers Mortgage Brokers

The annual net income calculator will display the result in the last field.

Annual income calculator alberta. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. Salary calculations include gross annual income tax deductible elements such as Child Care Alimony and include family related tax allowances. Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as.

The 261 factor is based on 261 working days in a calendar year 365 days minus weekends equals 261 working days. Your total annual income can impact how much mortgage you can afford. As a general rule to calculate income for child support you must identify the updated amounts related to the sources of income used to calculate your Total income on line 15000 150 for 2018 and prior years of the T1 General Form issued by the Canada Revenue Agency.

You can calculate your Annual take home pay based of your Annual gross income and the tax allowances tax credits and tax brackets as defined in the 2021 Tax TablesUse the simple annual Alberta tax calculator or switch to the advanced Alberta annual tax calculator to review NIS payments and income tax deductions for. Formula for calculating the minimum annual salary Hours per week x 52 weeks per year - Holiday Statutory weeks x hourly wages Annual Salary. Annual salary calculator for the minimum wage in Alberta for 2019 Hours per week - Holiday Statutory weeks Total annual working hours Minimum wage 15hour 13hour 598week 65543week 2848month x Hourly wage Annual minimum Salary.

Your average tax rate is 221 and your marginal tax rate is 349. Statutory holidays are included in the 261 as they are paid days for salaried employees. Adjustments are made for holiday and vacation days.

57 lignes How to Calculate Annual Salary. If youre buying a home with other people include their incomes too. Income Tax calculations and RRSP factoring for 202122 with historical pay figures on average earnings in Canada for each market sector and location.

Alberta Supports Contact Centre. This website uses cookies to give you a better online experience. Annual Income Living Costs Estimate for me.

How to find annual income - examples. A free calculator to convert a salary between its hourly biweekly monthly and annual amounts. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums. Skip to the main content. Gross household income in dollars.

The annual rate to three decimal places is calculated by multiplying the bi-weekly salary by 261. Before Tax Applicant Income Your gross income before-tax including any bonuses and supplementary income. If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488.

The Alberta Income Tax Salary Calculator is updated 202122 tax year. 7 lignes Easy income tax calculator for an accurate Alberta tax return estimate. By using this website or closing this message you are agreeing to our cookie policy.

Lenders check the income and credit history of all co-borrowers. How annual income is calculated under the Federal Guidelines. Look up the hourly wage or annual salary of hundreds of different occupations to help you figure out your future.

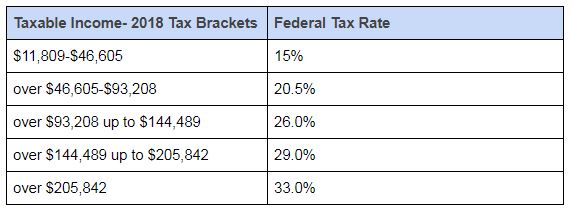

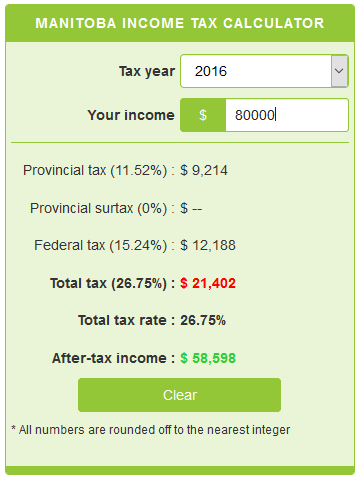

Property Tax An annual tax levied by the municipality in which your home is located. That means that your net pay will be 40512 per year or 3376 per month. The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

The Alberta Annual Tax Calculator is updated for the 202122 tax year. 15 40 52 31200. Gross household income is the total income before deductions for all people who live at the same address and are co-borrowers on a mortgage.

To determine her annual income multiply all the values. To get the appropriate amount for your situation you can consult the minimum wage page of Alberta. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice.

Toronto After Tax Income Calculator

Toronto After Tax Income Calculator

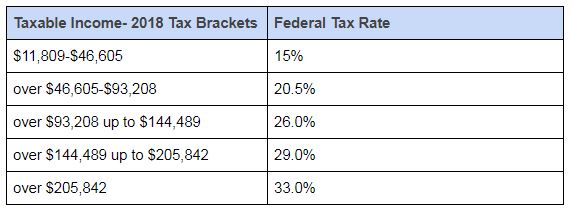

How To Calculate Income Tax In Excel

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

Shop Planner Business Planner Etsy Seller Planner Small Business Etsy Business Business Printable Business Goals Business Planner Small Business Organization Business Planning

Alberta Income Tax Calculator Wowa Ca

Canada Federal And Provincial Income Tax Calculator Wowa Ca

How To Calculate Income Tax In Excel

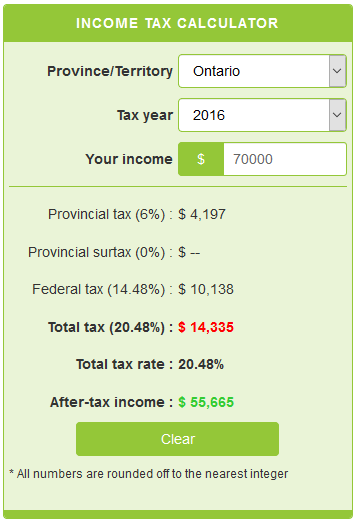

Canadian Income Tax Calculator Neuvoo

How To Calculate Income Tax In Excel

Top 6 Best Annual Salary Income Calculators 2017 Ranking Yearly Income Calculator To Calculate Annual Salary Advisoryhq

Canadian Income Tax Calculator Neuvoo

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Taxtips Ca Investment Income Tax Calculator 2020 And 2021

How To Create An Income Tax Calculator In Excel Youtube

Taxtips Ca Canadian Tax Calculator For Prior Years Includes Most Deductions And Tax Credits

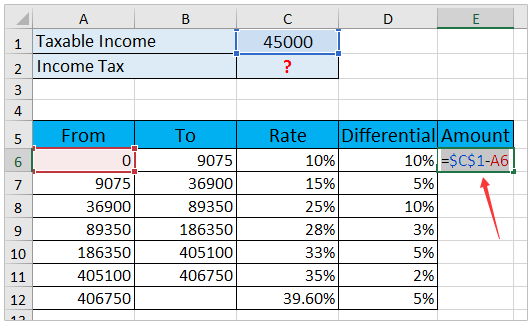

Manitoba Income Tax Calculator Calculatorscanada Ca

Income Tax Calculator Calculatorscanada Ca

Post a Comment for "Annual Income Calculator Alberta"