Gross Salary Meaning Australia

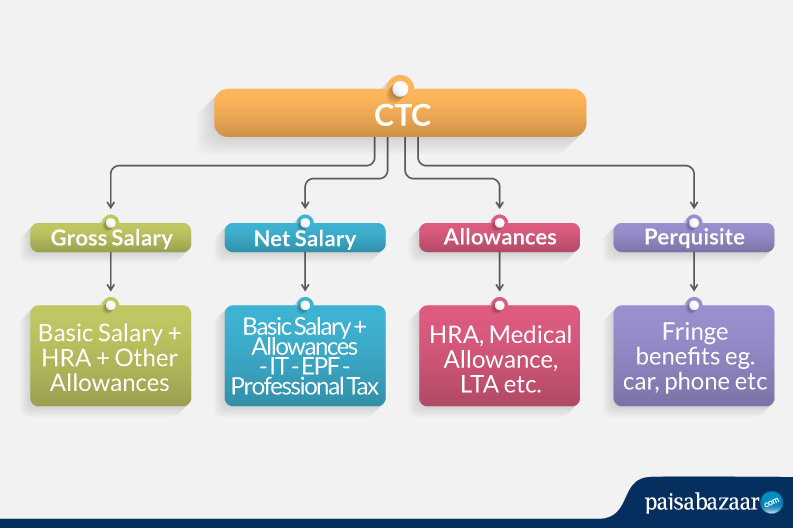

It is the gross monthly or annual sum earned by the employee. Gross Salary is the sum total of all the components of your compensationsalary package.

Silhouette Happy Family Fichier Vectoriel Libre De Droits Sur La Banque D Images Fotolia Com Image Silhouette People Family Silhouette Family Illustration

A pay period can be weekly fortnightly or monthly.

Gross salary meaning australia. For instance you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for. What is Gross Salary. Certain receipts such as lump sum receipts windfall gains and withdrawals from savings are not considered to conform to these criteria and are not included as income.

For calculation of Income Tax gross salary minus the eligible deductions are considered. The gross salary is mentioned in the companys offer letter in the compensation or salary section which mainly enlist all the components of the pay package. The key to tax-effective salary sacrifice is for the employee to take some of their remuneration in the form of concessionally taxed benefits instead of taking it all as fully assessable salary.

The aim of salary packaging is to enable an employee to receive a combination of income and benefits in a tax-effective manner. Gross earnings include the basic salary plus all additional money earned such as sales commissions and bonuses. Women receive a salary of 93532 AUD.

Taxation Process of Gross Salary. Gross income is regarded as all receipts which are received regularly and are of a recurring nature. So if you earn the current median male full time wage of 76700 as a base wage.

It is also before tax. Net Salary is the salaried employees net amount after deduction Income Tax PPF Professional Tax. A fantastic salary guide on what you should be earning -- in just a few clicks.

Men receive an average salary of 118571 AUD. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Gross salary is calculated by adding an employees basic salary and allowances prior to making deductions including taxes.

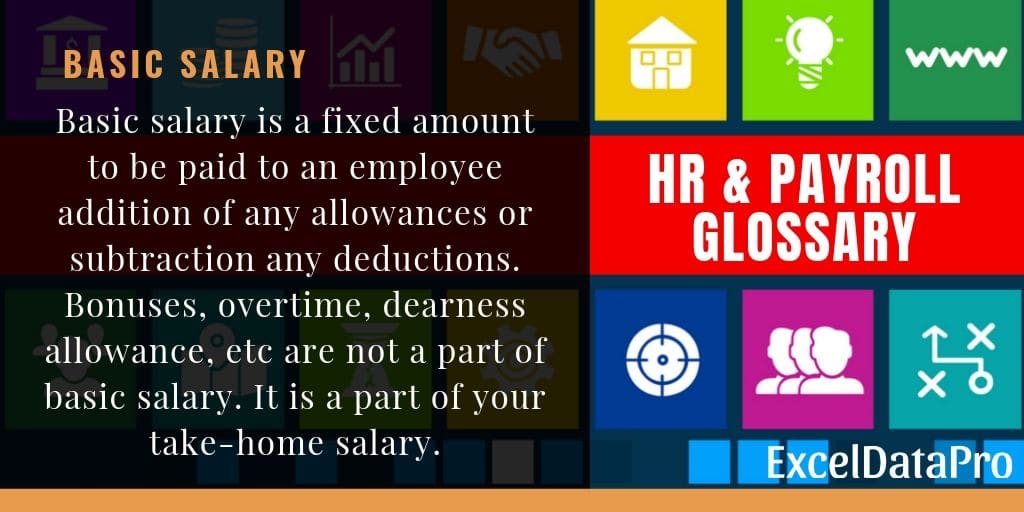

Average salary in Australia is 111241 AUD per year. According to the 2018 Robert Half Salary Guide a network engineer can earn a base salary. Here a basic salary is the base income of an employee or the fixed part of ones compensation package.

For example you will have to deduct HRA exemption any home loan EMI investments under section 80C and 80D and similar such things for calculation of taxable income. To calculate Income Tax gross salary minus the eligible deductions are considered. Gross salary can be defined as the amount of money paid to an employee before taxes and deductions are discounted.

Include the total gross. Gross salary is the maximum amount of the salary inclusive of all taxes. Salaries are different between men and women.

The sum of all those individual components on a yearly or monthly basis is the gross salary. So Net Salary Gross Salary Deductions Rs83000 Rs13000 Rs70000. Gross salary calculation can be initiated with the help of this mathematical formula.

With a salary package money is usually deducted from your salary before tax for these items or services. It can be used for the 201314 to 202021 income years. Therefore Net Salary Gross Salary Deductions Rs70000 Rs14000 Rs56000.

Net salary is less than the Gross salary amount after deducting all taxes. Gross salary Basic salary HRA Other Allowances. Gross and net calculator.

Gross salary is basically the salary which is without any deductions like income tax PF medial insurance etc. Net wages means take-home paythe amount on the paycheck after the employees gross earnings have been totaled and all taxes. Gross salary is the term used to describe all of the money youve made while working at your job figured before any deductions are taken for state and federal taxes Social Security and health.

This procedure is called Salary Sacrifice because the employee sacrifices some part of their salary. All data are based on 3277 salary surveys. The most typical earning is 66695 AUD.

The Australian Salaries is on its way to becoming one of the largest salary surveys in Australia. Taxation Process of Gross Salary. You will pay 16929 in tax and medicare but you are also entitled to.

Your employer will pay an extra 7286 into your Super fund as the compulsory super payment. It is the gross monthly or annual sum earned by the employee. It is up to the individual employer whether they advertise the salary or the salary package in job ads however Andrew Brushfield Director of Robert Half Australia says it is more common for a salary package to be advertised.

Gross payments Include all salary wages bonuses and commissions you paid your payee as an employee company director or office holder. Gross Salary is the amount employee earns in the whole year span of time without any deduction.

Salary Structure Components How To Calculate Take Home Salary

Download Adoption Tax Credit Calculator Excel Template Exceldatapro Tax Credits Excel Template Federal Income Tax

What Is Depreciation Meaning And Calculation Striaght Line Method In Ur Meant To Be Method Financial Accounting

Which Countries Use The Most Electricity Https Www Statista Com Chart 19909 Electricity Consumption Worldwi Electricity Consumption Electricity Infographic

Drapeau Europe Mutine Newsy Un Drapeau Europeen Incomplet Symbole D Une Chute Cards Gender Studies Country Flags

Your Invoices Gross Or Net Pricing Debitoor Invoicing

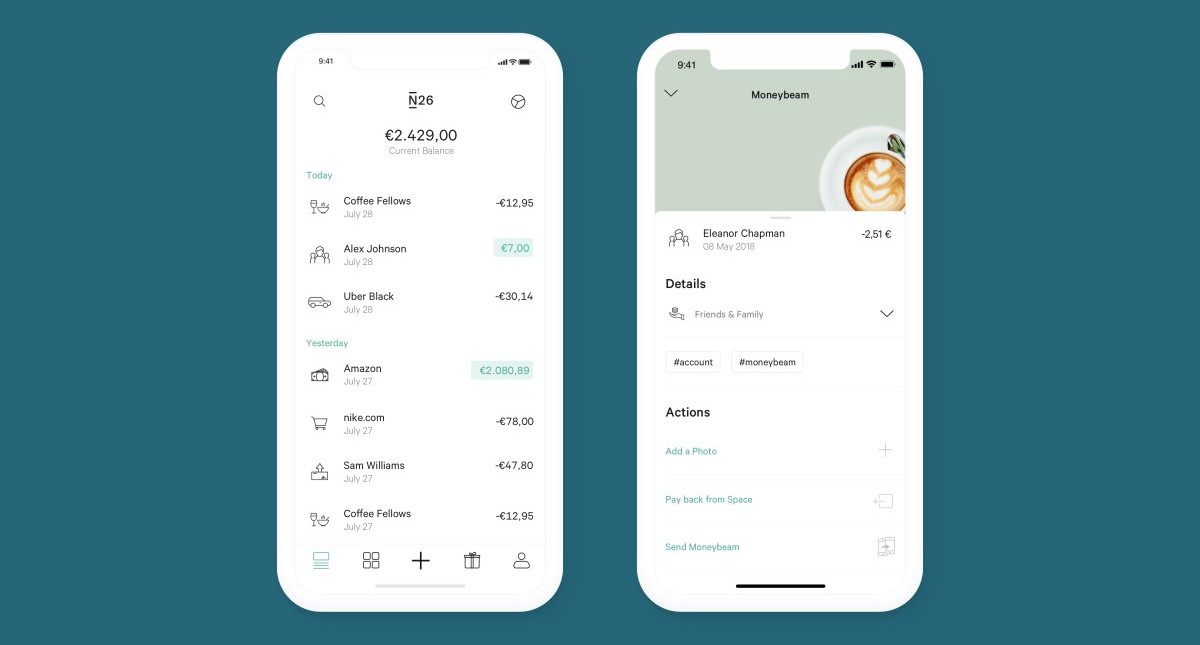

Base Salary Explained A Guide To Understand Your Pay Packet N26

Base Salary Explained A Guide To Understand Your Pay Packet N26

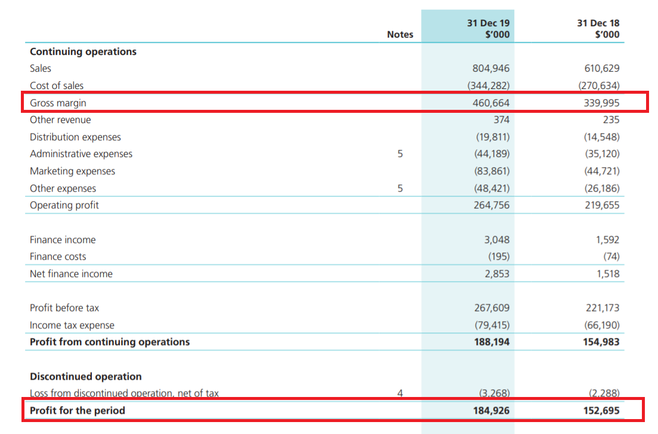

6 Essential Words To Understanding Your Business Finances Business Finance Finance Small Business Bookkeeping

Ytd Calculator And What Is Year To Date Income Calculator

Understanding Gross Vs Net Moneyhub Nz

Types Of Taxes Anchor Chart Financial Literacy Lessons Financial Literacy Anchor Chart Teaching Economics

Pin On Small Business Tax Tips

What Is Basic Salary Definition Formula Income Tax Exceldatapro

Salary Calculator Difference Between Gross Salary And Net Salary

Financevocabularywithenglishmedium In Accounting Revenue Is The Income That A Business Has From Its Normal Bu Word Of The Day Accounting And Finance Words

Income Statement Template Income Statement Template For Excel By Www Vertex42 Co Income Statement Income Statement Template Financial Statement Templates

Base Salary Explained A Guide To Understand Your Pay Packet N26

Post a Comment for "Gross Salary Meaning Australia"