Annual Income Calculator Oklahoma

Check the box - Advanced Federal Tax Calculator. The annual net income calculator will display the result in the last field.

Texas Paycheck Calculator Smartasset

Oklahoma Hourly Paycheck Calculator.

Annual income calculator oklahoma. Use this poverty level calculator to get 2021 annual and monthly federal poverty income levels and percentages for your household size in Oklahoma. How to use the tax calculator. After a few seconds you will be provided with a full breakdown of the tax you are paying.

To use our Oklahoma Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. This Oklahoma hourly paycheck calculator is perfect for those who are paid on. First determine your hourly pay rate and working time.

The states top income tax rate of 500 is in the bottom half of all states. Federal Standard Deduction 595000 405000. The other 2 weeks are vacation.

Tax Rate Threshold Tax Due in Band. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. When considering both state and local sales taxes the state has the.

15 40 52 31200. This is the average yearly salary including housing transport and other benefits. How to find annual income - examples.

Annual Income for 2021. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. Next determine any additional.

Calculate your Oklahoma net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Oklahoma paycheck calculator. This relatively low income threshold for the highest bracket means most Okies will pay this 5 rate on at least a portion of their income. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. Use the salary calculator above to quickly find out how much tax you will need to pay on your income. It isnt all good news for Oklahoma taxpayers however.

Federal Standard Deduction 595000 9405000. The Sooner States property taxes are also below average with an average effective rate of 087 25th-lowest in the US. Using our Oklahoma Salary Tax Calculator.

Household Income by Metro Area in Oklahoma. In order to determine an. For the 2020 tax year Oklahomas top income tax rate is 5.

Rank of place out of 50 by mean household income of the top 5. Oklahoma State Tax Tables. Use this free tool to calculate 2020 Oklahoma Poverty Levels including monthly totals annual income amounts and percentages of Oklahoma Poverty Levels like 133 135 138 150 200 and more.

There are 22 metro areas that are fully or partially contained within Oklahoma 21 fully and 1 partially. State Income Tax Total from all Rates. Simply enter your annual or monthly gross salary to get a breakdown of your taxes and your take-home pay.

The calculator takes your gross income along with the other information you provided it with and uses it to calculate the final amount that you take home. This marginal tax rate means that your immediate additional income will be taxed at this rate. A person working in Oklahoma typically earns around 92200 USD per year.

How to calculate annual income from hourly. To determine her annual income multiply all the values. Oklahoma has a six-bracket progressive income tax system.

However this top tax rate applies to taxable income over just 7200 for individual filers or 12200 for couples filing jointly and heads of household. On average the number of weeks worked per year is around 50 weeks. For example if you are a filing your taxes as single have no children are below the age of 65 and you are not blind with the consideration of the standard tax deduction your calculation would look like this.

Enter your Oklahoma State income. Oklahoma State Standard Deduction 1 x 100000 100000 305000. Enter annual income from highest paying job.

Enter pay periods per year of your highest paying job. Your working time will include days per week hours per day and weeks per year. Confirm Number of Dependants.

29339 60159 74405 95761 47755 57173 64692 69813 47196. 24a To calculate the households profit sharing income from an S corporation the worker uses the ordinary business income shown on line 1 of the Schedule K-1 Shareholders Share of Income and divides the income by 12 or the number of months the business existed in the tax year to arrive at the monthly gross unearned income. 5633 11551 14286 18386 9169 10977 12421 13404 9062 12661 15788 18455 Required annual income before taxes.

If you have a third job enter its annual income. 23 lignes Annual taxes. Tax Rate Threshold Tax Due in Band.

Oklahoma State Standard Deduction 1 x 100000 100000 9305000. Oklahoma State Tax Tables. Enter annual income from 2nd highest paying job.

For instance an increase of 100 in your salary will be taxed 3613 hence your net pay will only increase by. Salaries range from 23300 USD lowest average to 412000 USD highest average actual maximum salary is higher. Oklahoma State Tax Calculator.

Salaries vary drastically between different careers. That puts Oklahomas top income tax rate in the bottom half of all states. Percentage above or below mean household income of the top 5 of Oklahoma.

Enter your annual income. Press Calculate to see your State tax and take home breakdown including Federal Tax deductions. If you have vacation pay for these days enter your weeks as the full 52 weeks.

How to use the advanced tax calculator. Annual Income for 2021.

Idaho Retirement Tax Friendliness Retirement Calculator Life Insurance Tips Property Tax

Oklahoma Paycheck Calculator Smartasset

Oklahoma Sales Tax Small Business Guide Truic

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Paycheck Calculator For Excel Paycheck Consumer Math Salary Calculator

New Teacher Pay Raise Faqs Oklahoma State Department Of Education

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

Usda Loan Payment Calculator Calculate Loan Guarantee Eligibility Closing Costs How Much You Can Afford To Borrow

Quarterly Tax Calculator Calculate Estimated Taxes

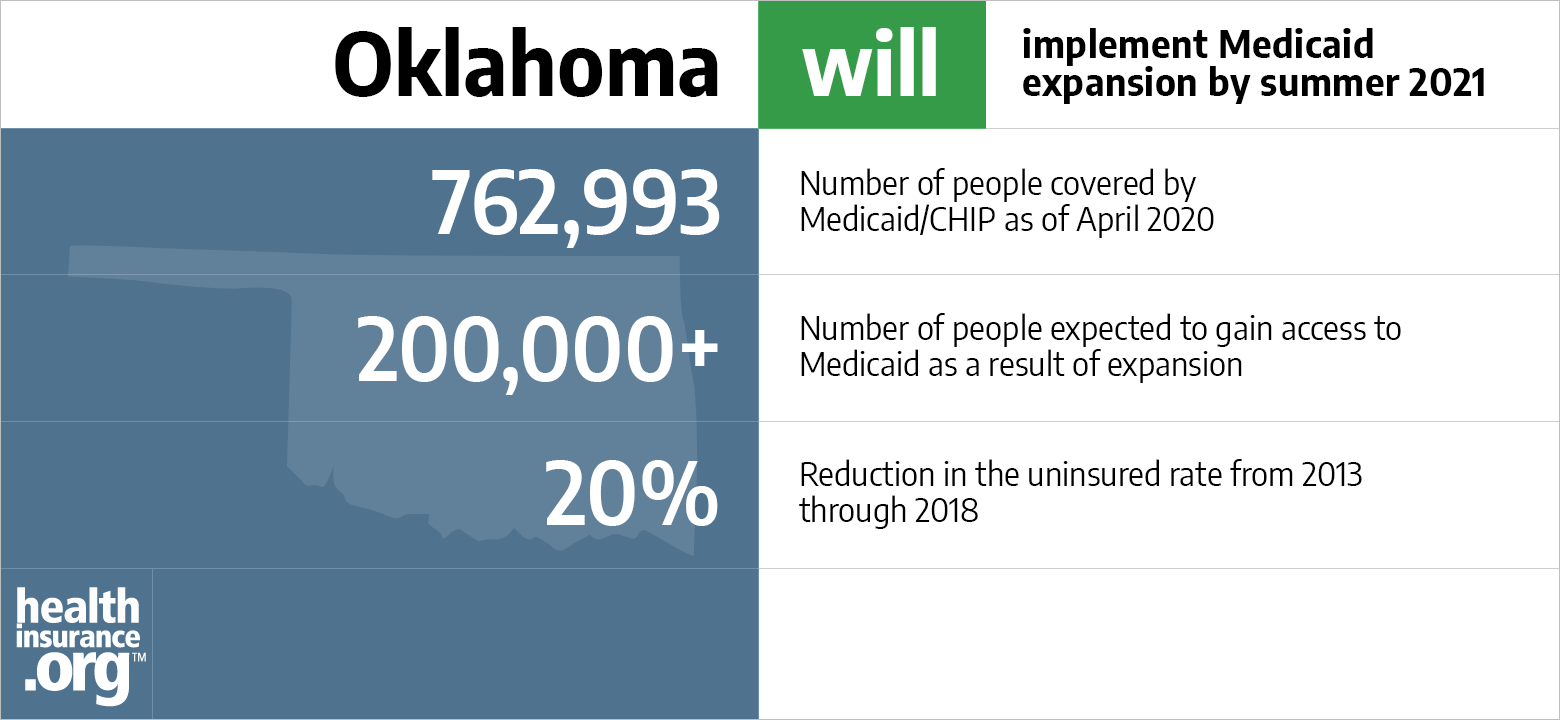

Oklahoma And The Aca S Medicaid Expansion Healthinsurance Org

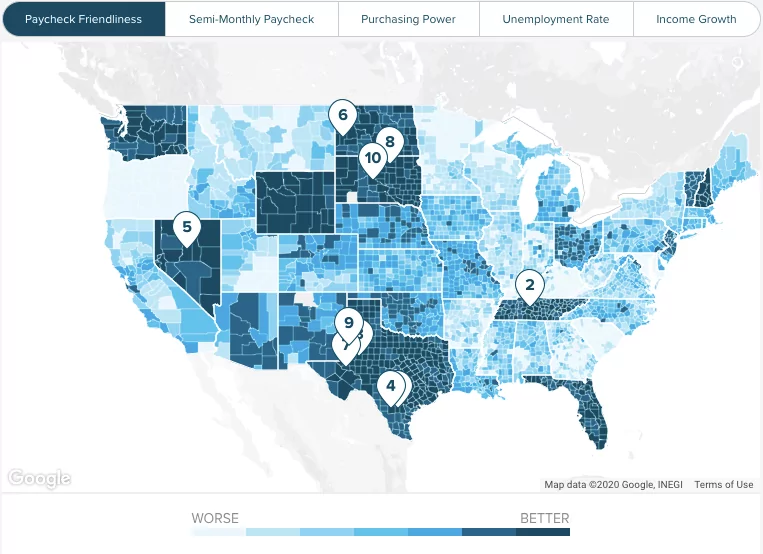

Oklahoma Retirement Tax Friendliness Smartasset Com Income Tax Brackets Retirement Retirement Income

Doing Economics Empirical Project 5 Working In Excel

Oklahoma Paycheck Calculator Smartasset

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Salary Calculator Hourly Monthly Annual Income Calculator

4 Ways To Calculate Annual Salary Wikihow

Oklahoma Wage Calculator Minimum Wage Org

Free Online Paycheck Calculator Calculate Take Home Pay 2021

Post a Comment for "Annual Income Calculator Oklahoma"