Salary Calculator Hourly Ireland

14hour 120 hours 1680. If you have an annual salary of 30000 it equates to a monthly pre-tax salary of 2500 weekly pay of 57692 and an hourly wage of 1442 per hour.

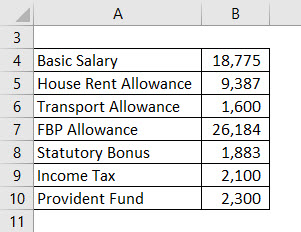

Salary Formula Calculate Salary Calculator Excel Template

Then multiply the product by the number of weeks in a year 52.

Salary calculator hourly ireland. Full salary after tax calculation for Ireland based on 6000000 annual salary and the 2021 income tax rates in Ireland. Companies can back a salary into an hourly wage. By default the 2021 22 tax year is applied but if you wish to see salary calculations for other years choose from the drop-down.

More detailed salary. For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. See how we can help improve your knowledge of Math.

Workers paid hourly are compensated by multiplying the agreed hourly rate by the total number of hours worked in a given period eg month week or day. For other sources of income and benefits in kind the calculator assumes that these. To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week.

How to calculate annual salary from hourly rate To determine your annual salary take your hourly wage and multiply it by the number of paid hours you work per week and then by the number of paid weeks you work per year. Calculate you Hourly Rate salary after tax using the online New Zealand Tax Calculator updated with the 2021 income tax rates in New Zealand. Youll be able to see the gross salary taxable amount tax national insurance and.

One of a suite of free online calculators provided by the team at iCalculator. Just two simple steps to calculate your salary after tax in Ireland with detailed income tax calculations. The average salary for a Engineer is 46087 in Dublin Ireland.

See how we can help improve your knowledge of Math Physics Tax Engineering and. That is the compensation the worker will receive at the end of. Includes Health Insurance Pension Social Security tax rates deductions personal allowances and tax free allowances in Ireland.

However the 62 that you pay only applies to income up to the Social Security tax cap which for 2021 is 142800 up from 137700. Salaries submitted anonymously to Glassdoor by Engineer employees in Dublin Ireland. Also known as Gross Income.

One of a suite of free online calculators provided by the team at iCalculator. 30000 a year is how much per hour. Need more from the Ireland Tax Calculator.

5 days ago FICA contributions are shared between the employee and the employer. For instance if a grocery store hires cashiers for an hourly rate of 1500 per hour on a full-time schedule of 40 hours a week you can calculate the annual pre-tax salary by multiplying the hourly rate by 40. 9 hours ago 297 People Used More.

Salary Before Tax your total earnings before any taxes have been deducted. Yearly salary hourly wage hours per week weeks per year. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Youll then get a breakdown of your total tax liability and take-home pay. If you wish to enter you monthly salary weekly or hourly wage then select the Advanced option on the Ireland tax calculator and change the Employment Income and Employment Expenses period. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor.

So the salary looks like this. 62 of each of your paychecks is withheld for Social Security taxes and your employer contributes a further 62. Step 1 hours per week.

Salary Calculator Instructions. Lets look at some common round salary figures and their equivalent hourly pay. Salaries estimates are based on 315.

When youre done click on the Calculate button and the table on the right will display the information you requested from the tax calculator. You can our salary to hourly calculator to find out how much youre earning each month week day and hour. This is the amount of salary you are paid.

That you are an individual paying tax and PRSI under the PAYE system. For example if over the past four weeks you worked 30 hours in week one 40 hours in week two 50 hours in week three and 40 hours during week four your. Hourly Salary - SmartAsset.

Lets assume that hourly rate equals 14 and the employee has worked 120 hours per month with no overtime. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. The Ireland tax calculator assumes this is your annual salary before tax.

You can now choose the tax year that you wish to calculate. Carefully follow these steps to convert your hourly wage into an annual income figure. But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52.

Enter the number of hours per week you typically work. Calculate your income tax social security and pension deductions in seconds. This number will be an average.

Ireland Salary Calculator 2021

Base Salary Explained A Guide To Understand Your Pay Packet N26

Salary To Hourly Salary Converter Salary Finance Hour

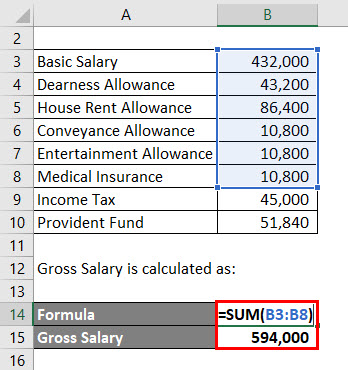

Salary Formula Calculate Salary Calculator Excel Template

Ie Income Tax Calculator July 2021 Incomeaftertax Com

What Is Annual Income How To Calculate Your Salary Salary Calculator Income Tax Return Income

Salary Formula Calculate Salary Calculator Excel Template

42 000 After Tax 2021 Income Tax Uk

The Salary Calculator Required Salary

The Salary Calculator Irish Take Home Tax Calculator Salary Calculator Weekly Pay Salary

Salary Formula Calculate Salary Calculator Excel Template

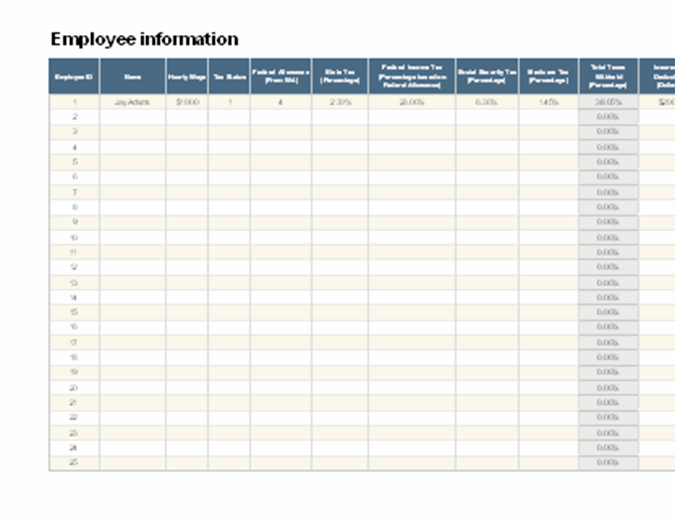

Hourly Paycheck Calculator Templates 10 Free Docs Xlsx Pdf Salary Calculator Paycheck Payroll Taxes

Taxcalc Ie An Irish Income Tax Calculator

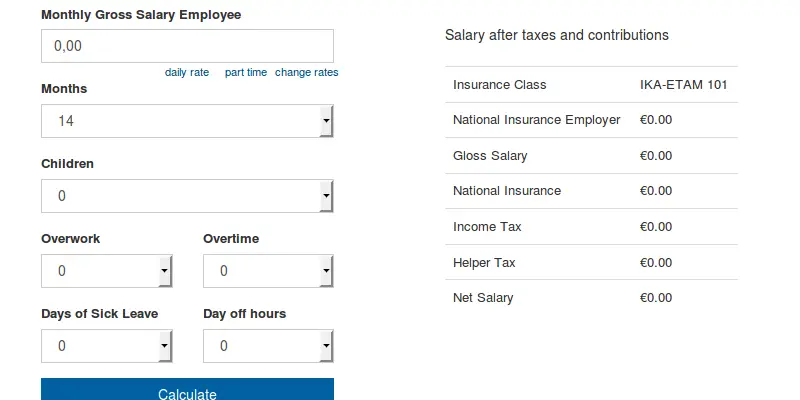

Net Salary Calculator Of Employee For Greece Updated For 2021 Vasilis Vontikakis

Speed Calculator Omni Energy Calculator Speed Calculator

Post a Comment for "Salary Calculator Hourly Ireland"