Gross Pay Rate

Gross rate of pay excludes. To calculate the employees gross pay during a biweekly pay period multiply their hourly rate by 80 hours worked.

Gross Salary Vs Net Salary Top 6 Differences With Infographics

Gross pay hourly rate number of ____ Mathematics.

Gross pay rate. However states may have their own minimum wage rates that override the federal rate as long as it is higher. A pay period can be weekly fortnightly or monthly. The following steps outline the.

This estimator will help you to work out an estimate of your gross pay and the amount withheld from payment made to you as a payee where. The gross pay estimator will give you an estimate of your gross pay based on your net pay for a particular pay period. Gross Pay Hourly Employees Hourly Rate X Hours Worked.

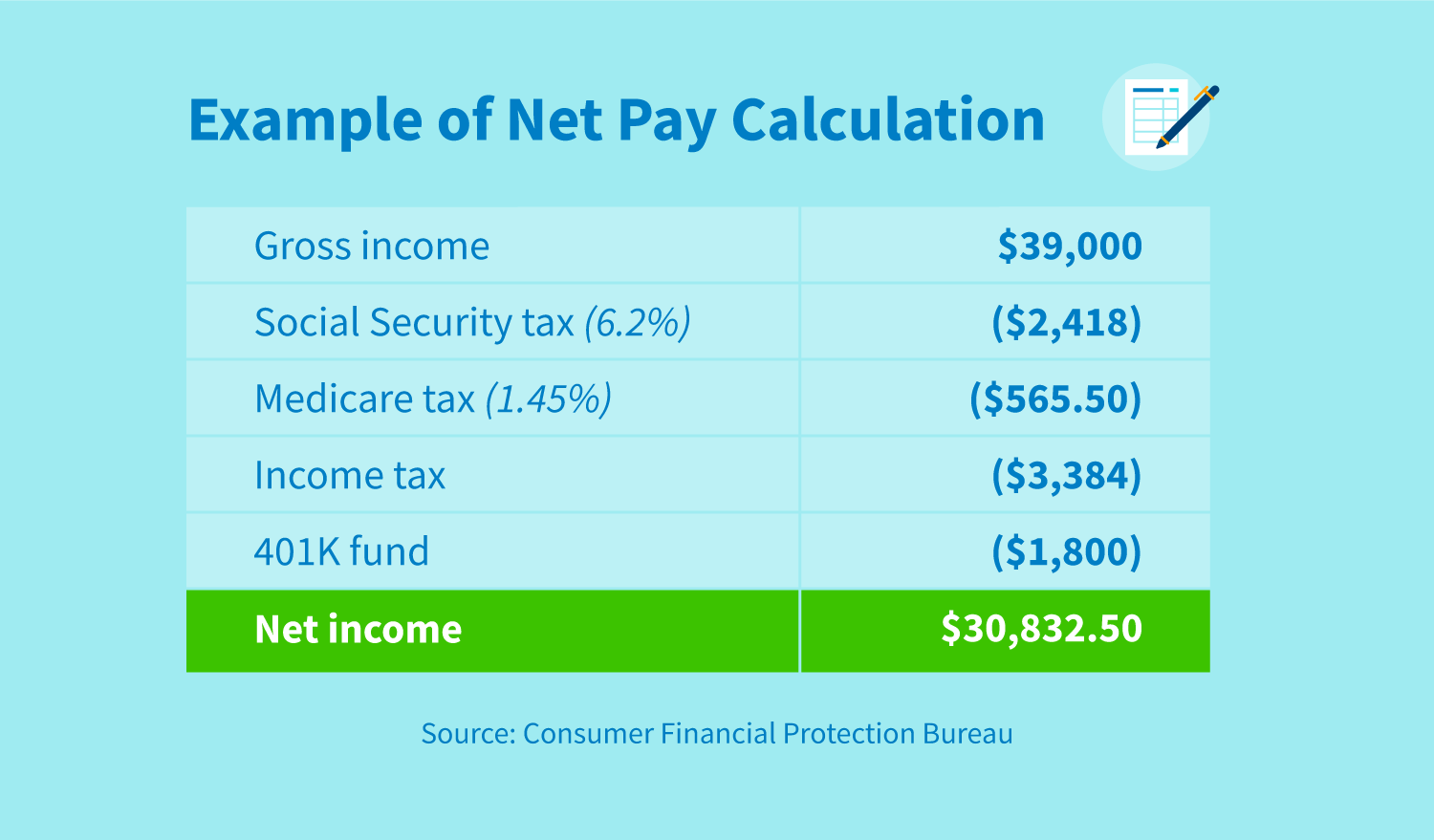

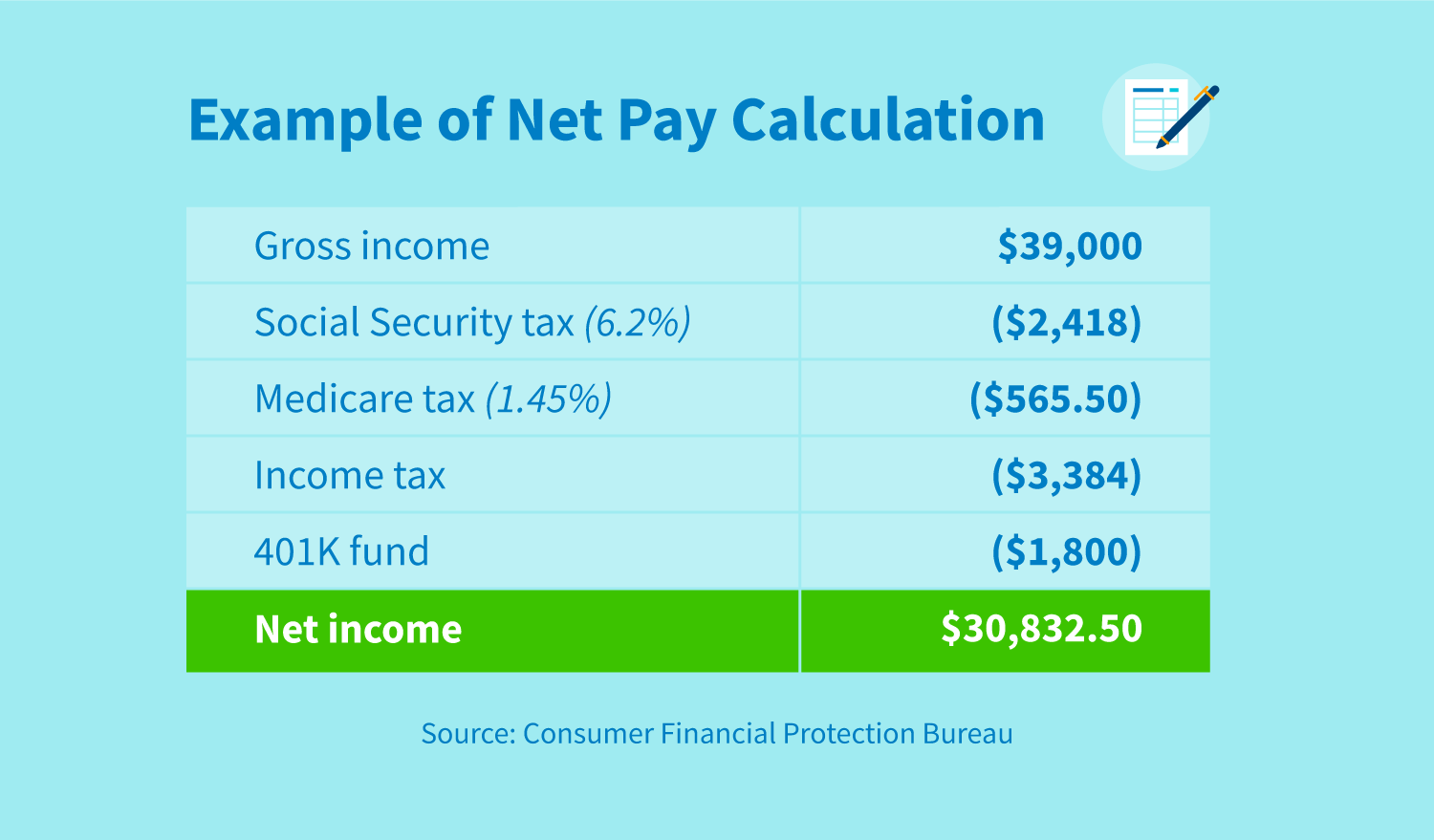

Your portion as an employer is also 145 with no limit but you the employer dont have to pay the additional 09 For a total of 765 withheld based on the employees gross pay. You might be interested in. The amount of unemployment benefit payable in this case is 60 of your most recent gross pay whatever your family situation and it remains unchanged.

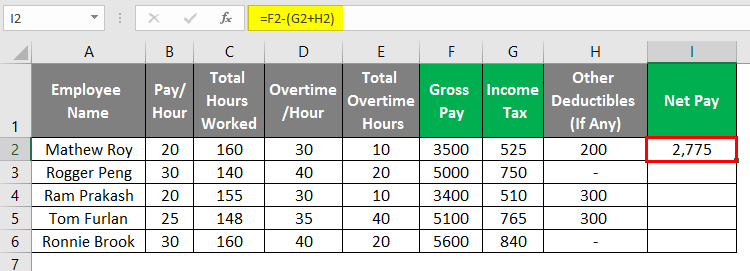

Calculate Gross Pay functions In order to calculate the gross pay we have created the weeklyPay hours wage function. Gross pay may also include pay above and beyond a set salary such as overtime. Calculating gross salary with overtime or commission.

Multiply your weekly pay by 48 to find out your gross salary per year. Generally to determine gross pay an individual or business multiplies the number of hours worked by the pay rate. Wages based on an hourly rate and salaries based on an annual rate Bonuses Shift differentials Commissions Commission Commission refers to the compensation paid to an employee after completing a task.

FICA payroll taxes are 153 percent of your employees gross pay after the pre-tax deductions are accounted for. It is a reflection of the total amount your employer pays you based on your agreed-upon salary or hourly wage. 2 Doing the Withholding Calculations.

SUPPLEMENTAL INSTRUCTION PROGRAMS -. Overtime payments bonus payments and annual wage supplements AWS. Total Gross Pay for Regular Rate 1125 hour Overtime Rate 1688 hour Double Time Rate 2250 hour.

For example if your employer agreed to pay you 15 per hour and you work for 30 hours during a pay period your gross pay will be 450. The employees biweekly gross wages are. This function will be called from the input for hours and wage from the user.

For example an employee who earns 3000 per month will owe 22950 in FICA tax. Gross pay includes the following. Travel food and housing allowances.

This amount is split between. It can be used for the 201314 to 202021 income years. Pentagon 3 3 months ago.

This is 007 more an hour compared to last year. Many unversities and colleges have instituted supplemental instruction SI programs in which student facilitator meets regular. A Band 2 on a 2nd and final pay point has an annual salary of 1953037.

For example if you earn 20 an hour and work 40 hours a week your gross weekly salary is 800 your monthly is 3200 and your gross annual pay is 41600 per year. Fourth add up any additional deductions such as health premiums charity deductions etc. Their gross total hourly income before deductions is 999 per hour.

Once youve added up all of the deductions above subtract the sum from the gross pay to reach your total net pay. Their net take home hourly rate is 822. The Medicare withholding rate is gross pay times 145 with a possible additional 09 for highly-paid employees.

Reimbursement of special expenses incurred in the course of employment. The federal minimum wage rate is 725 an hour. Hours worked all together Send.

The amount used for gross pay includes any additional income an employee earned such as overtime. However if the hours worked are greater than 40 the rate of pay must be 15 times the rate of regular hourly pay. For instance the District of Columbia DC has the highest rate of all states at 1500 and will use that figure for wage-earners in that jurisdiction instead of the federal rate.

For example you pay a full-time employee an hourly rate of 12. For instance a worker who earns 10 an hour and works 2732 hours in a year is paid 27320 in gross pay. Find out what you owe by multiplying gross pay by 765.

Average Salary In France 2021 The Complete Guide

Payroll In Excel How To Create Payroll In Excel With Steps

Gross Income Vs Net Income Creditrepair Com

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Annual Income Learn How To Calculate Total Annual Income

The Difference Between Net Pay And Gross Pay A Simple Guide Hourly Inc

Salary Net Salary Gross Salary Cost To Company What Is The Difference

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The Difference Between Gross And Net Pay Economics Help

Base Salary Explained A Guide To Understand Your Pay Packet N26

What Is Base Salary Definition And Ways To Determine It Snov Io

Salary Formula Calculate Salary Calculator Excel Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Income Vs Net Income Creditrepair Com

Earnings Statistics Statistics Explained

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

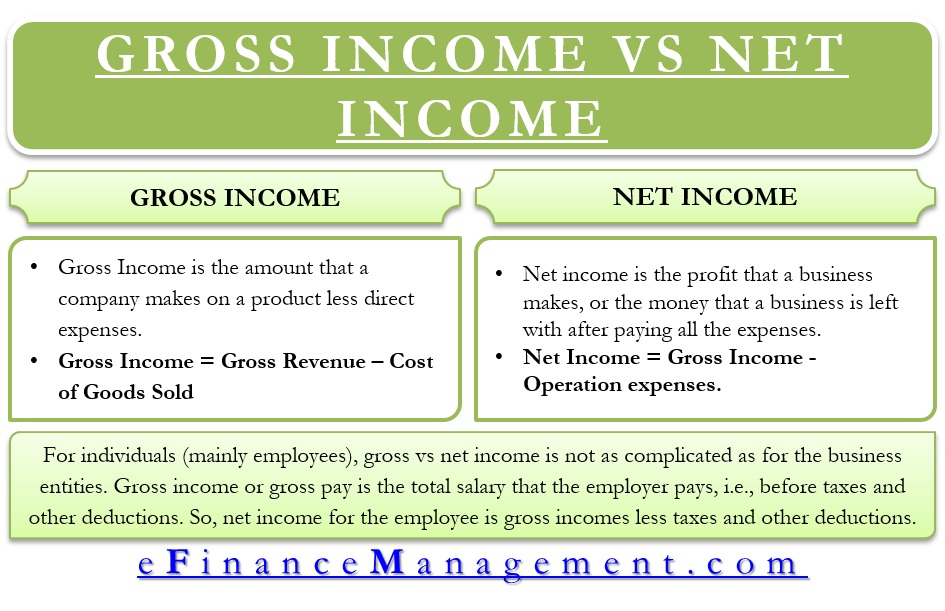

Difference Between Gross Income Vs Net Income Definitions Importance

Gross Income Formula Step By Step Calculations

Post a Comment for "Gross Pay Rate"