Gross Pay Hourly Calculator

Of regular hours Regular rate per hour. Hours worked may include waiting time on-call time rest and meal breaks travel time overtime and training sessions.

Margin Calculator Calculator How To Find Out Finance Tools

-Overtime gross pay No.

Gross pay hourly calculator. Net annual salary Weeks of work year Net weekly income. This article describes the two most common ways -hourly and salary. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Of overtime hours Overtime rate per hour. The government contribution is capped at 154175 per month. 30 8 260 62400.

48 750 dollars is. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. -Regular gross pay No.

To calculate hourly rate from annual salary divide yearly salary by the number of weeks per year and divide by the numbers of working hours per week. Gross Pay Hours Hourly Wage Overtime Hours Hourly Wage 15 Commission Bonuses. In case of the first tab named Gross pay.

Take for example a salaried worker who earns an annual gross salary of 25000 for 40 hours a week and has worked 52 weeks during the year. Multiply the hourly wage by the number of hours. Net weekly income Hours of work week Net hourly wage.

Generally to determine gross pay an individual or business multiplies the number of hours worked by the pay rate. This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. KiwiSaver Student Loan Secondary Tax Tax Code ACC PAYE.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. Gross pay estimator This link opens in a new window it will take between 2 and 10 minutes to use this calculator. In case you want to convert hourly to annual income on your own you can use the math that makes the calculator work.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Gross Pay Hourly Formula. How do I calculate salary to hourly wage.

As long as you work 20 or more of your full-time hours your employer will pay an extra 5 of the remainder of your pay and the government will pay 6167 of the remainder as well. It can be used for the 201314 to 202021 income years. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as.

The amount used for gross pay includes any additional income an employee earned such as overtime. 14hour 120 hours 1680. Hourly gross pay is calculated by multiplying the number of hours worked in the pay period times the hourly pay rate.

That is the compensation the worker will receive at the end of. The algorithm behind this hourly paycheck calculator applies the formulas explained below. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. The results are broken down into yearly monthly weekly daily and hourly wages. New Zealands Best PAYE Calculator.

So the salary looks like this. Calculate your take home pay from hourly wage or salary. How do you calculate hourly rate from annual salary.

Calculating gross pay for hourly wages varies depending on a businesss pay structure. Annual salary AS HR WH 52 weeks in a year Monthly salary MS AS12. The following steps outline the calculation for gross pay for hourly wages.

The algorithm behind this hourly to salary calculator applies the formulas provided below. There are lots of different ways to calculate gross pay depending on how an employee is paid. Divide this number by the gross pay to determine the percentage of taxes taken out of a paycheck.

48 750 dollars a year is how much every two weeks. Lets assume that hourly rate equals 14 and the employee has worked 120 hours per month with no overtime. So if he gets paid Rs100 an hour and he works eight hours his gross pay is Rs800.

Gross Annual Income of hours worked per week x. If an employee is paid hourly he is paid a fixed amount for every hour of work. Workers paid hourly are compensated by multiplying the agreed hourly rate by the total number of hours worked in a given period eg month week or day.

Salary To Hourly Salary Converter Omni Salary Hour Converter

Hello Please Create The Following In Html Amp Chegg Com

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Awesome Salary Calculator Salary Calculator Salary Calculator

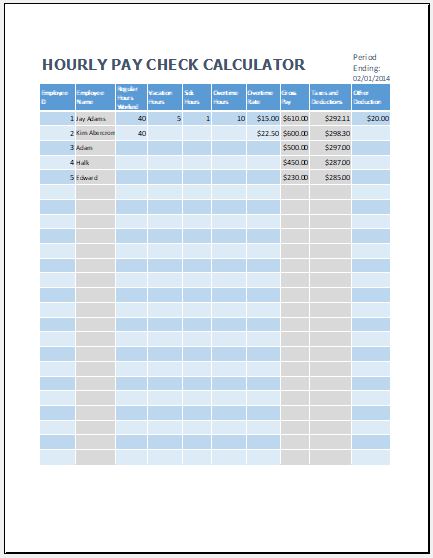

Excel Payroll Calculator Template Software Download Payroll Template Payroll Excel Spreadsheets Templates

Quickbooks Payroll Calculator For Calculating Salary Quickbooks Payroll Quickbooks Payroll

Hourly Paycheck Calculator Template For Excel Excel Templates

Salary To Hourly Salary Converter Salary Finance Hour

Women S Day Gender Pay Gap Gender Pay Gap Wage Discrimination Gender Gap

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Salary To Hourly Conversion Chart

How To Make A C Calculate Pay Program Using Loops And If Else Statements Youtube

Top 7 Free Payroll Calculators Timecamp In 2021 Payroll Payroll Software Savings Calculator

Amazon Com Paycheck Calculator Salary Or Hourly Plus Annual Summary Of Tax Holdings Deductions No Ads Appstore For Android

3 Ways To Work Out Gross Pay Wikihow

Terms Used When Calculating Payroll Payrollhero Support

Post a Comment for "Gross Pay Hourly Calculator"