Gross Annual Employment Income Calculator

If you make 52000 a year living in the region of Ontario Canada you will be taxed 11488. And you can figure out are you eligible for and how much of Low Income Tax Offset you can get.

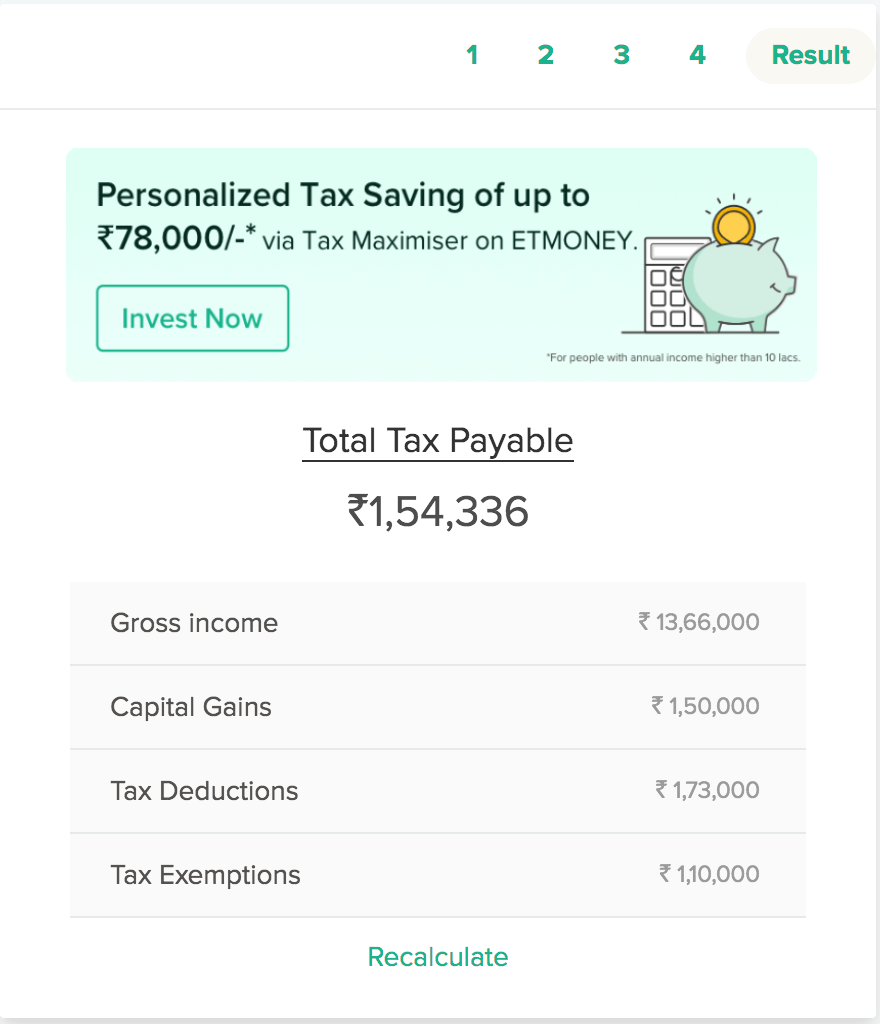

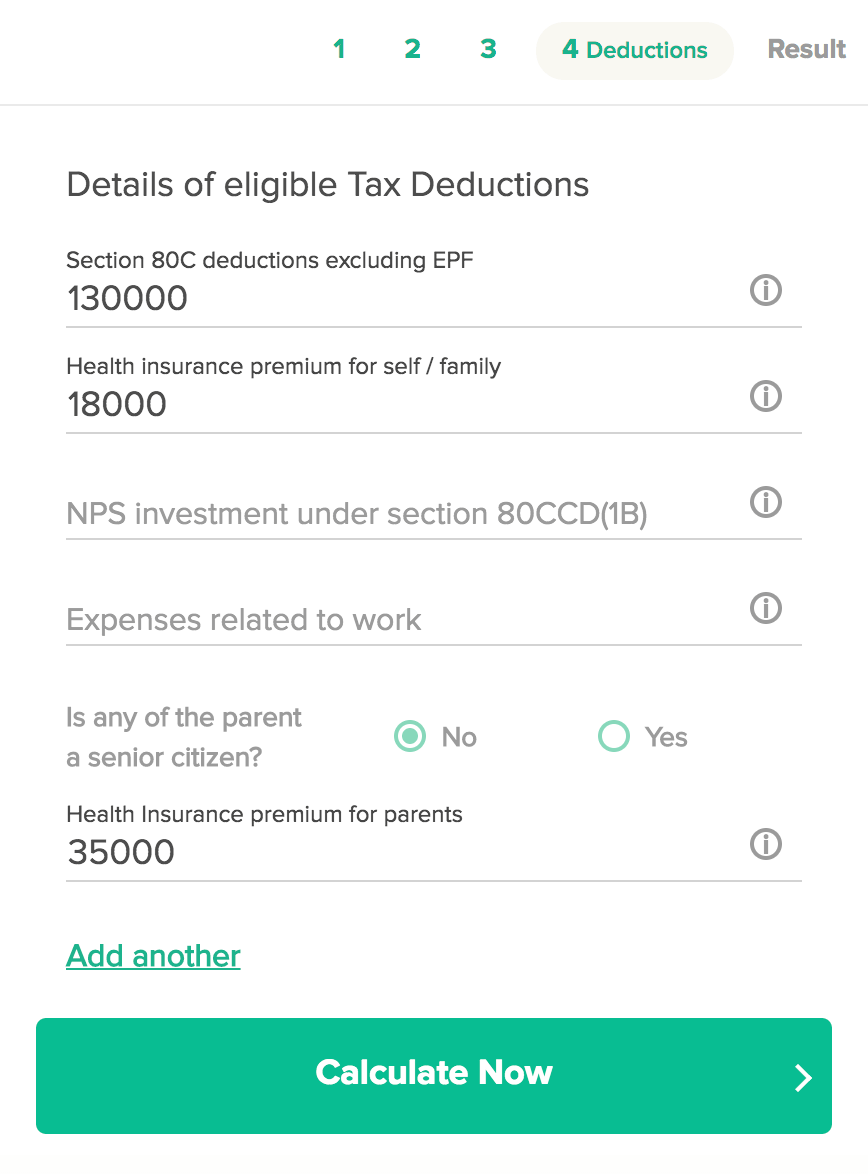

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Our salary calculator will provide you with an illustration of the costs associated with each employee.

Gross annual employment income calculator. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income. Thats because your employer withholds taxes from each paycheck lowering your overall pay.

Adjusted Gross Income AGI is your. Upon retirement both NSSF and pension contributions are based on an individuals gross income the Upper earning limit of KSh 18000 while the Lower earning limit of KSh 6000. The adjusted annual salary can be calculated as.

That means that your net pay will be 40512 per year or 3376 per month. Above the line deductions - IRS approved items that can be subtracted from net income. 30 8 260 - 25 56400.

This is the basis for many other calculations made. We applied relevant deductions and exemptions before calculating income tax withholding. The annual net income is calculated by subtracting the amounts related to the tax Canada Tax and Ontario Tax the Ontario surtax the Canadian Pension Plan the Employment Insurance.

Annual Income Calculator Enter your hourly rate days per week worked of weeks worked per year and hours per day into the annual income calculator. In order to calculate the gross annual income at the date of application the same calculation outlined above will be used. You will see the costs to you as an employer including tax NI and pension contributions.

This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. What gross earning means. The pension contribution is 12 of the pensionable wages made up of two equal portions of 6 from the employee and 6 from the employer subject to an upper limit of KSh 2160 for employees earning above KSh.

Net annual salary. The 52 represents the number of weeks you work throughout the year. For example if you work roughly 35 hours per week every week and you earn 16 per hour your gross annual income would be.

The 8 of gross earnings component in an employees final pay. Firstly you need to enter the annual salary that you receive from your employment and if applicable any overtime or pension details. 30 8 260 62400 As can be seen the hourly rate is multiplied by the number of working days a year unadjusted and subsequently multiplied by the number of hours in a working day.

But calculating your weekly take-home pay isnt a simple matter of multiplying your hourly wage by the number of hours youll work each week or dividing your annual salary by 52. If all of the components of gross earnings are not. This is because should a tax code change for any reason it will.

You can read more about it in the gross to net calculator. The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas.

If you work fewer weeks you want to use that number instead. We strongly recommend you agree to a gross salary rather than a net salary. Gross income is money before taxation.

Because of the numerous. It can be used for the 201314 to 202021 income years. For the purposes of calculating payments for holidays and leave gross earnings means all payments that the employer is required to pay to the employee under the employees employment agreement for the period during which the earnings are being assessed.

Youll then get a breakdown of your total tax liability and take-home pay. Gross annual income - Taxes - Surtax - CPP - EI Net annual salary. Estimated number of hours worked per week x hourly rate x 52 gross annual income.

To calculate gross annual income enter the gross hourly wage in the first field of this yearly salary calculator. Use the calculator to work out an approximate gross wage from what your employee wants to take home. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

The result in the fourth field will be your gross annual income. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary. Then enter your annual income and outgoings from self-employment.

Also known as Gross Income. We offer you the chance to provide a gross or net salary for your calculations. Gross annual income calculator.

The first four fields serve as a gross annual income calculator. Use this calculator to quickly estimate how much tax you will need to pay on your income. Your average tax rate is 221 and your marginal tax rate is 349.

Total income received within the last six. The calculator needs some information from you before working out your tax and National Insurance. Your tax code age and other options might also affect your calculations.

To better compare withholding across counties we assumed a 50000 annual income. We then indexed the paycheck amount for each county to reflect the counties with the lowest withholding burden or. If you have HELPHECS debt you can calculate debt repayments.

Salary Before Tax your total earnings before any taxes have been deducted. First we calculated the semi-monthly paycheck for a single individual with two personal allowances. The calculator took one of these for you known as the self employment deduction.

Gross pay estimator This link opens in a new window it will take between 2 and 10 minutes to use this calculator. This marginal tax rate means that your immediate additional income will be taxed at this rate.

How To Calculate Net Income 12 Steps With Pictures Wikihow

Self Employed Calculate Your Quarterly Estimated Income Tax Xendoo

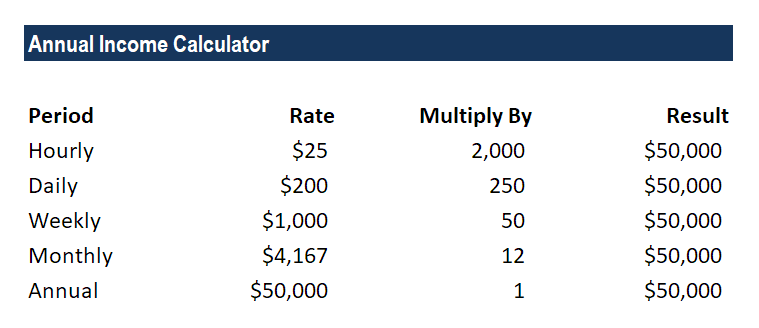

Annual Income Learn How To Calculate Total Annual Income

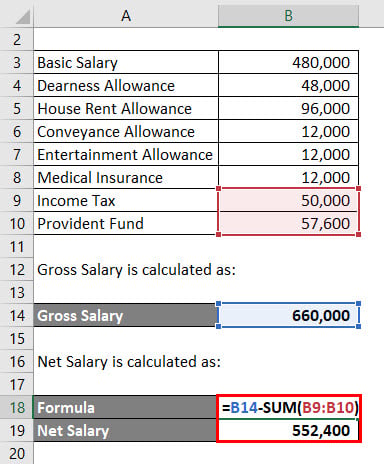

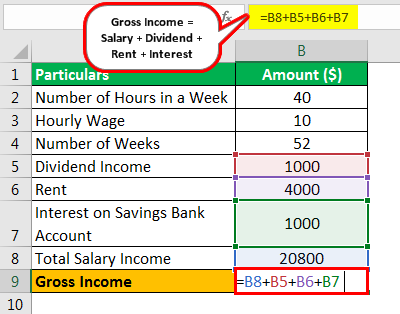

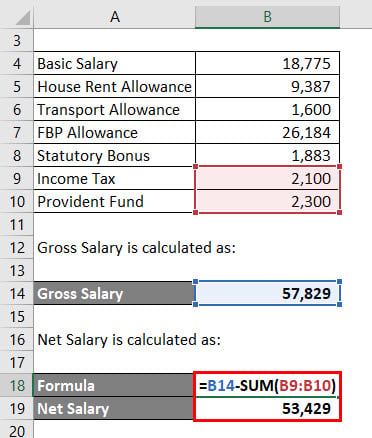

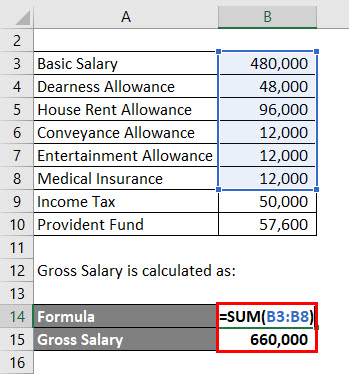

Salary Formula Calculate Salary Calculator Excel Template

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

4 Ways To Calculate Annual Salary Wikihow

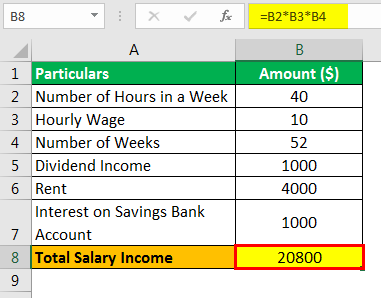

Gross Income Formula Step By Step Calculations

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Paycheck Calculator Take Home Pay Calculator

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Net Salary The Urssaf Converter

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

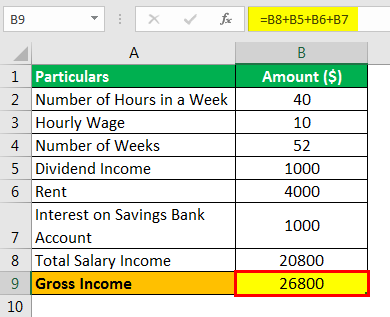

Gross Income Formula Step By Step Calculations

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Gross Income Formula Step By Step Calculations

Gross Pay And Net Pay What S The Difference Paycheckcity

Post a Comment for "Gross Annual Employment Income Calculator"