Annual Income Calculator Two Jobs

There are two ways to determine your yearly net income. Youll then get a breakdown of your total tax liability and take-home pay.

Hourly To Salary Calculator Convert Your Wages Indeed Com

There are two types of annual income.

Annual income calculator two jobs. Net pay 40568. Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be calculated as. Have a regular part time job and receive a taxable pension or government allowance.

We recommend claiming the tax-free threshold from the payer who usually pays the highest salary or wage. Daily rate x 250. When speaking about annual income it is important to make the correct distinction.

Other Factors Affecting Pay If you ever work overtime and are paid at higher than normal rates for it you will make a higher rate of pay in those pay periods. Multiply your hourly wage by the number of work hours per day. EI deduction - 822.

Some money from your salary goes to a pension savings account insurance and other taxes. Provincial tax deduction - 2783. Factors such as health insurance savings increased daycare expenses additional transportation costs etc.

To calculate a paycheck start with the annual salary amount and divide by. A working spouse can provide additional needed household income. 57 lignes How to Calculate Annual Salary.

Hourly rates weekly pay and bonuses are also catered for. This number is the gross pay per pay period. If your main residence is in Scotland tick the Resident in Scotland box.

Lets work through how to calculate the yearly figure by using a simple example. How to use the two jobs calculator. Enter your gross income.

Assume that Sally earns 2500 per hour at her job. This calculator is always up to date and conforms to official Australian Tax Office rates and formulas. Example of Annual Income Calculator.

Enter your salary details below to check what you have been taxed against what you should be taxed. It is common to mention the annual income on job vacancy ads and on business reports. Experiment with other financial calculators or explore hundreds of individual calculators covering other topics such as math fitness health and many more.

Also known as Gross Income. Net income is the money after taxation. Income calculator two jobs.

Hourly rate x 2000. How to calculate annual income from hourly. Set the net hourly rate in the net salary section.

This calculator takes into account your main income and therefore will make sure any additional deductions due to increased tax. Why not find your dream salary too. 2 days ago Annual income is the total earnings within a one year period for a person or a business.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. Need to be considered. To get started enter your annual salary from your first job and the salary from the second job.

The paycheckcity salary calculator will do the calculating for you. When you are checking your tax code the tax year pension type student loan type and your sexdob must be the same for the incomes entered - this is so that a combined income can be created. Multiply 25 per hour by 2000 working hours in a year 8 hours x 5 days per week x 50 weeks per year.

Have two or more jobs. This information may appear right on the pay stub or on the documentation you received when you accepted the job. Federal tax deduction - 5185.

These are gross annual income. Here are the steps to calculate annual income based on an hourly wage using a 17 hourly wage working 8 hours per day 5 days a week every week as an example. Simply enter your annual or monthly income into the salary calculator above to find out how taxes in Ireland affect your income.

Your other payers then withhold tax from your income. Salary Before Tax your total earnings before any taxes have been deducted. The latest budget information from April 2021 is used to show you exactly what you need to know.

First determine your hourly pay rate and working time. If you have more than one payer at the same time we generally require that you only claim the tax-free threshold from one payer. On average the number of weeks worked per year is around 50 weeks.

30 8 260 62400. For instance if you work 40 weeks out of the year and make 240 per week you would earn 240 40 9600 per year at that job. What would her annual income be if she works 8 hours per day 5 days per week and 50 weeks per year.

Next determine any additional. Weekly rate x 50. Annual net income calculator.

Where do you work. You can use the two jobs calculator to see what happens to your total take-home when you take a second job. To get started enter your annual salary from your first job and the salary from the second job.

If you have vacation pay for these days enter your weeks as the full 52 weeks. In our example your daily salary would be 136 17 per hour times 8 hours per. The other 2 weeks are vacation.

Income calculator two jobs. Salary After Tax the money you take home after all taxes and contributions have been. You can calculate your gross annual income using other measurements besides monthly income if necessary.

Total tax - 11432. Use this calculator to find out how much you need to earn in your second job in order to get the take home pay you require. This will apply the Scottish rates of income tax.

This calculator takes into account your main income and therefore will make sure any additional deductions. Multiply your estimated weeks of work by your weekly pay. To calculate a paycheck start with the annual salary amount and divide by the number of pay periods in the year.

Compare Tax on Two Jobs Tax Calculator. Subtract any deductions and payroll taxes from the gross pay to get net pay. Dont want to calculate this by hand.

Use this calculator to quickly estimate how much tax you will need to pay on your income. CPP deduction - 2643. Income Tax Calculator Canada Find out how much your salary is after tax.

Salaried employees also have another option for figuring out their gross annual income. Your working time will include days per week hours per day and weeks per year. Enter either your gross hourly wage into the first field or your gross annual income into the fourth field.

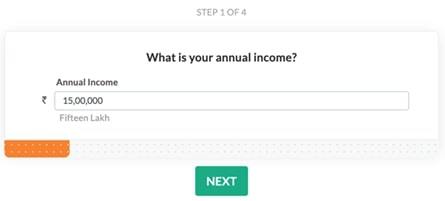

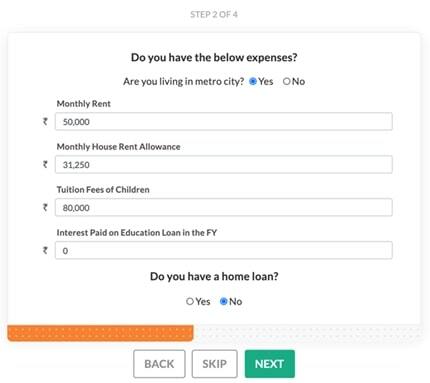

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

How To Calculate Net Income 12 Steps With Pictures Wikihow

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Annual Income Learn How To Calculate Total Annual Income

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

3 Ways To Calculate Your Hourly Rate Wikihow

New Mexico Paycheck Calculator Smartasset

Online Income Tax Calculator Calculate Income Taxes For Fy 2020 21 Scripbox

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Salary To Hourly Salary Converter Salary Finance Hour

What You Need To Know About Income Tax Calculation In Malaysia

Health Insurance Marketplace Calculator Kff

4 Ways To Calculate Annual Salary Wikihow

How To Calculate Net Income 12 Steps With Pictures Wikihow

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Annual Income Learn How To Calculate Total Annual Income

Post a Comment for "Annual Income Calculator Two Jobs"