Annual Income Calculator Australia

Compare your income to the median salary in Australia The median wage per hour in Australia is 36 in 2021. The Australian salary calculator for 202122 Annual Tax Calculations.

Simply select the appropriate tax year you wish to include from the Pay Calculator menu when entering in.

Annual income calculator australia. This Australian Tax Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be taking into account current ATO tax rates. If you are repaying HELPHECS debt click the relevant box to say Yes. The ATO publish tables and formulas to calculate weekly fortnightly and monthly PAYG income tax instalments that can vary from the annual tax amounts.

Welcome to iCalculator AU this page provides a 202122 Australia 17200000 Income Tax Calculation with example of income tax and salary deductions. If you need a detailed calculation you can use the Income tax estimator. Calculate annual income australia.

25 is about 48 750 dollars a year. See how much youll be paid weekly fortnightly or monthly with our easy to use pay calculator. This calculator is always up to date and conforms to official Australian.

The Salary Calculator will also calculate what your Employers Superannuation Contribution will be. And you can figure out are you eligible for and how much of Low. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

What is the Average Income in Australia. Australian Tax Calculator 2020. You can personalise this tax illustration by choosing advanced and altering the setting as required.

After changing the advanced tax calculator setting click on calculate to recalculate your tax deductions based on the latest Australian. The median monthly household income in Australia is 739125 before tax and other deductions. If your income is around 300 a week youre in the 15600 to 20799 per annum income bracket for Australia along with 10 per cent of other income earners.

The Annual salary calculator for Australia. It can be used for the 201314 to 202021 income years. The reason is to make tax calculations simpler to apply but it can lead to discrepancies.

If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. If you make 60000 a year your hourly salary is approximately 30 an. For more information see assumptions and further information.

How much Australian income tax you should be paying. How to find annual income - examples. Differences will always be favour of the ATO however these will be refunded when the annual year tax return is processed.

This calculator will give you an estimate of your gross pay based on your net pay for a particular pay period weekly fortnightly or monthly. Your marginal tax rate. The Tax Calculator will also calculate what your Employers Superannuation Contribution will be.

15 40 52 31200. The annual net income calculator will display the result in the last field. Press calculate on the calculator to calculate your yearly gross.

Total tax and tax rates calculation of Australia in 2021 based on your annual daily or hourly salary. This calculator can also be used as an Australian tax return calculator. To determine her annual income multiply all the values.

If you have HELPHECS debt you can calculate debt repayments. To use the Australian tax calculator. Your income is lower than the median hourly wage.

Learn your salary taxes and superannuation contributions. The Money Pay Calculator can be used to calculate taxable income and income tax for previous tax years currently from the 2015-2016 tax year to the most recent tax year 2020-2021. Enter your salary into the Annual Salary field.

It can be used for the 201314 to 202021 income years. What your take home salary will be when tax and the Medicare levy are removed. This Australian Salary Calculator will show you what your weekly fortnightly monthly Income or Net Salary will be after PAYG tax deductions.

This calculator helps you to calculate the tax you owe on your taxable income. This works out to a salary of 88695 per year although its important to remember that this counts for households not individuals. If your salary includes Superannuation click the relevant box to say Yes.

Use this calculator to quickly estimate how much tax you will need to pay on your income. Step Three Define your savings goals. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year.

Enter your Annual salary and click calculate. This 172k salary example uses a generic salary calculation example for an individual earning 172k per year based on the 2021 personal income tax rates and thresholds as published by the ATO. 50 of people also earn less than this figure and the statistics only include those people who earn enough to pay income tax.

Net to Gross Income - Rise High. Simple tax calculator This link opens in a new window it will take between 2 and 10 minutes to use this calculator.

How To Calculate Income Tax In Excel

How To Create An Income Tax Calculator In Excel Youtube

Payroll Tax Deductions Business Queensland

How To Calculate Income Tax In Excel

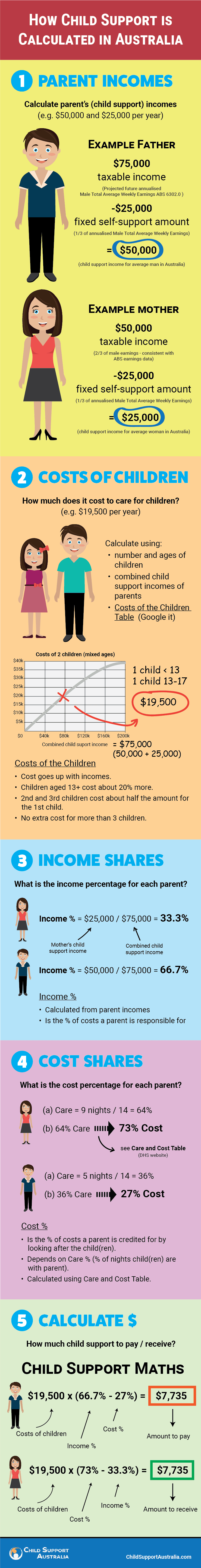

How Child Support Is Calculated Child Support Australia

Australian Tax Calculator Excel Spreadsheet 2018 To 2025 Atotaxrates Info

Setting Your Hourly Rate Professional Contractors And Consultants Australia

What You Need To Know About Income Tax Calculation In Malaysia

Setting Your Hourly Rate Professional Contractors And Consultants Australia

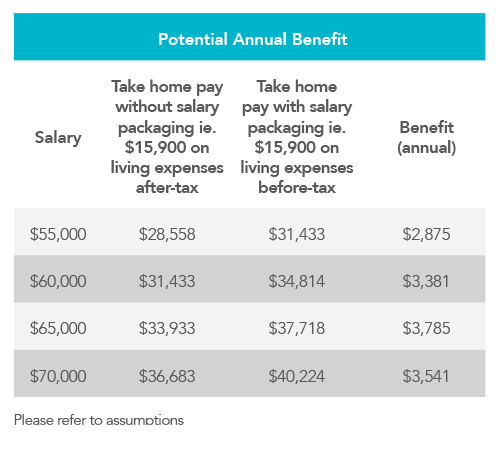

Could A Help Hecs Debt Impact My Salary Packaging Remserv

Tax Brackets Australia See Individual Income Tax Tables Etax Online Tax

2021 Salary Calculator Robert Half

Australia 125000 Salary After Tax Australia Tax Calcu

Income Gross Up Calculator Peard

Calculating Payroll Accrual Percentages Australia Only Support Notes Myob Accountedge Myob Help Centre

Setting Your Hourly Rate Professional Contractors And Consultants Australia

Taxable Income Formula Examples How To Calculate Taxable Income

Calculating Income Tax Payable Youtube

Post a Comment for "Annual Income Calculator Australia"