Hourly To Salary Washington State

41 lignes Average Salary Washington State. So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Washington Salary Calculator uses Washington as default selecting an alternate state will use the tax tables from that state.

The Salary You Need To Be Paid In Every State To Afford A Home In 2021 30 Year Mortgage Buying Your First Home Poverty Rate

Most Washington state workers who are paid an hourly wage and work more than 40 hours in a 7-day work week must be paid overtime.

Hourly to salary washington state. This is equivalent to 35100 on an annual basis. Enter your salary or wages then choose the frequency at which you are paid. Annonce Payroll Employment Law for 140 Countries.

So if you earn 10 an hour enter 10 into the salary input and select Hourly Optional Select an alternate state the Washington salary comparison calculator uses Washington as default selecting an alternate state will use the tax tables from that state. Take the hourly rate of pay and multiply by the number of overtime hours times 15 to determine the inflated time and a half gross amount of pay due. The FTE employment by hourly wages are based on a full-time-equivalent basis where 1 FTE job 2088 hours worked during 2019.

Average Hourly Rate for Washington State University WSU Employees. Employment records at multi-site locations are assigned by an algorithm to match the proportion of employment and payroll at that site. The threshold will increase incrementally each year until 2028 when it is expected to be about 25 times the.

On July 1 2020 Washingtons minimum salary threshold will increase from 250 per week to 675 per week or 125 times the states minimum wage. Simply enter their federal and state W-4 information as well as their pay rate deductions and benefits and well crunch the numbers for you. Enter your info to see your take home pay.

When paying overtime a business must pay at least one and one-half times the workers regular hourly rate. Home Health Aide HHA Certified. Annonce Payroll Employment Law for 140 Countries.

Is there a Penalty for Failing to Follow Pay Day Laws. With differing minimum hourly wages around the state. This rate can be an hourly wage salary flat rate piece rate commission etc.

You can earn an average hourly wage rate of 1675-2200hr with the ability to be rewarded even more with our amazing no-capped. Hours worked is defined as all hours during which the employee is authorized or required known or reasonably believed by the employer to be on the premises or at a prescribed workplace This can include. Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Washington.

FTE will be less than monthly employment from the Quarterly Census of Employment and Wages QCEW which counts a part-time job as one job. Global salary benchmark and benefit data. 7152014 ADMINISTRATIVE POLICY DISCLAIMER This policy is designed to provide general information in.

Changes to the Salary Threshold. Find out what you should be paid. Global salary benchmark and benefit data.

SmartAssets Washington paycheck calculator shows your hourly and salary income after federal state and local taxes. Average salary in Washington State is 88777. Enter your salary or wages then choose the frequency at which you are paid.

122002 WAC 296-126 and WAC 296-128 REVISED. Salary employees reference above section to determine the hourly. Make sure you are locally compliant with Papaya Global help.

11 - 17 Estimated Average. Failure to pay the legal minimum wage and other violations may result in payment of back. 22 lignes Hourly pay to annual salary Hourly pay Weekly pay 40 hrs Monthly pay avg Annual.

Base Hourly Rate USD 543. State of Washington WA Jobs by Hourly Rate. Make sure you are locally compliant with Papaya Global help.

STATE OF WASHINGTON DEPARTMENT OF LABOR AND INDUSTRIES EMPLOYMENT STANDARDS TITLE. See WAC 357-28-240 through 265 for additional definitions about overtime. When an employee is paid hourly they must be paid for all hours worked.

Use Our Oregon Paycheck Calculator To Calculate Your Take Home Pay Per Paycheck For Both Salary And Hourly Jobs After Taking Into A Paycheck Hourly Jobs Salary

Javascript Developer Salaries According To Gooroo Marketing Trends Javascript Development

Software Engineer Salaries December 2016 Software Development Software Engineer Software

Washington State Minimum Wage In 2019 2020 Atlas Workbase

Average Annual Salaries For Phlebotomists By State From Highest To Download Table

Rent Prices Vs Javascript Developer Salaries In Major Tech Hubs Marketing Trends Development Javascript

Average Wages By County Map Office Of Financial Management

Average Wages By County Map Office Of Financial Management

Washington And U S Average Wages Office Of Financial Management

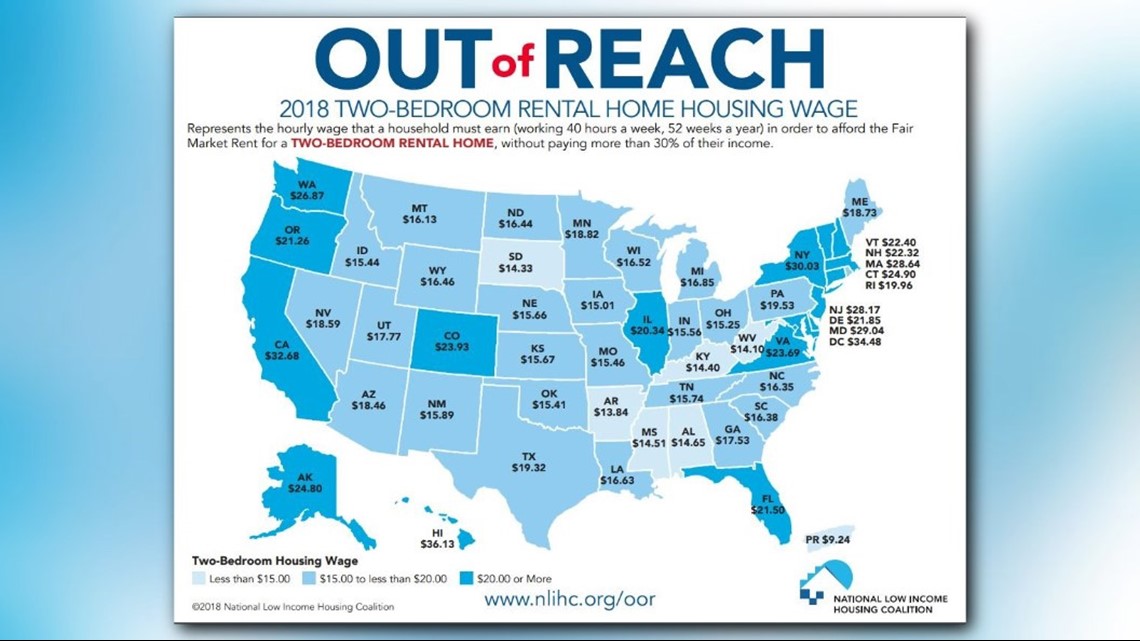

This Is How Much You Need To Earn For Rent In Washington King5 Com

The Average Python Developer States By State Gooroo It Tech Software Engineering Software Development Programming Jokes Development

Nurse Salaries Which Us States Pay Rns The Best 2019 Updated

Pharmacy Technician Salary Average Pay Per Hour 2012

Washington Paycheck Calculator Smartasset

Pin On Money And Soul Prosperity Finance Financial Education Wealth

Israel Vs Ukraine Software Developer Salaries It Tech Remote Software Development Software Software Engineer

Average Software Developer Salaries In Different Us States Software Development Development Web Developer Salary

Post a Comment for "Hourly To Salary Washington State"