Gross Pay Calculator Ireland

TaxCalc allows you to estimate your take home pay based on your total pay pension contribution and personal circumstances. For example for gross weekly earnings of 377.

The Salary Calculator Pro Rata Tax Calculator

The tax is progressive five tax brackets it starts at 15 for incomes up to 49020 CAD and ends at 33 for incomes greater than 216511 CAD.

Gross pay calculator ireland. For other sources of income and benefits in kind the calculator assumes that these. Increase in second USC rate band from 20484 to 20687. The increase in the standard rate band is not transferable between spouses or civil partners so the first spouse or civil partners tax bands would be calculated as 44300 20 8860 and 3700 40 1480.

Enter Desired Net Pay. ESI is calculated on 075 of Gross Pay Basic and LOP dependent allowances or 21000 whichever is lower Rules for calculating payroll taxes FY 2019 2020 Income Tax formula for FY 2019 2020. You will also find supporting links to the latest corporation and personal income tax tabes inIreland.

Within this field enter the absolute take home pay figure for the employee. Use Deloittes Irish Tax Calculator to estimate your net income based on the provisions in the latest Budget. The second spouse or civil partners tax bands would be calculated as 26300 20 5260 and 700 40 280.

The gross wage will be calculated automatically for you and displayed on screen. If you are paid weekly your Income Tax IT is calculated by. A minimum base salary for Software Developers DevOps QA and other tech professionals in Ireland starts at 35000 per year.

Adding the two amounts above together. Compare Contrast With TaxCalc you will be able to see a breakdown of all your deductions from your gross pay and estimate how much a pay increase or deduction is going to impact on your pocket. The same as the median gross Dublin income of 3333 EUR.

Your gross income of 3333 EUR per month for a single person is. Calculate one-sixth of your earnings over 35201. You can find detailed information on how to calculate payroll in Ireland in 2021 below the calculator and details about the features within the tool.

This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor. Gross pay is the employees pay of any kind including. Once an employee has been selected a pop up box will appear on screen Enter Desired Net Pay.

Divided by 6 417. The employees pay before any pension contributions or salary sacrifice deductions are made. This should equal the PAYMENT figure.

The result is the amount of PRSI you pay. Chapter 3 of the Employers Guide to PAYE details the different types of pay that would be included. Two weeks pay x 8 16 Two weeks pay x 200 days 400 days 105 A Bonus weeks pay 1.

Applying the standard rate of 20 to the income in your weekly rate band. That you are an individual paying tax and PRSI under the PAYE system. At the same time more leading roles like Software Architect Team Lead Tech Lead or Engineering Manager can bring you a gross annual income of 90000 without bonuses.

Their statutory redundancy payment will be calculated as follows. 377- 35201 2499. Is calculated based on a persons gross taxable income after the non-refundable tax credits have been applied QPIP CPPQPP and EI premiums.

The Ireland Payroll Calculator includes current and historical tax years this is particularly useful for looking at payroll trends is your initial payroll cost going to increase significantly for example. Increase in Earned Income Credit from 1500 to 1650. Taxable pay is your gross pay less any contributions you make to a.

For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately. Applying the higher rate of 40 to any income above your weekly rate band. Deducting the amount of your weekly tax credits from this total.

The results should in no way be viewed as definitive for personal tax purposes for your individual tax payment. Median Gross Income per Month Single Ireland has one of the strongest economies in Europe relative to its population boasting the fourth highest GPD per capita in the world in 2019.

Payroll Accrual Spreadsheet Accrual Spreadsheet Template Spreadsheet

Work Out Your Salary After Taxes At Maltasalary Com Salary Workout Pie Chart

How To Calculate Cost Of Manufacturing Apparel Products Online Clothing Study Cost Of Production Manufacturing Cost Sheet Format

Official Launch Wedding Planner Pricing Guide Wedding Planning Worksheet Party Planner Business Wedding Planner Packages

Pin By Carmie Mo On Art Tutorials Inspo Net Profit Accounting Training Profit

Vat Calculator Ireland Ireland Calculator Online

Pin On Time And Date Calculators

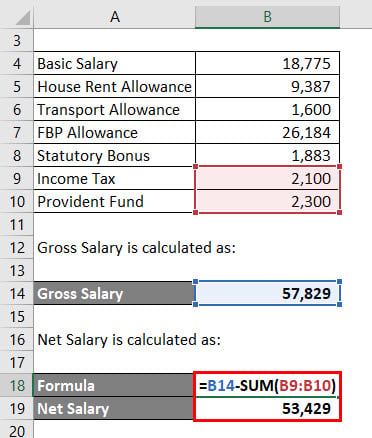

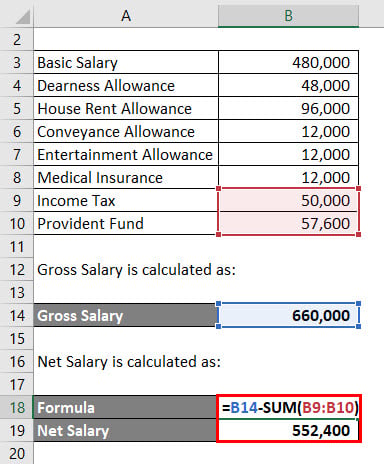

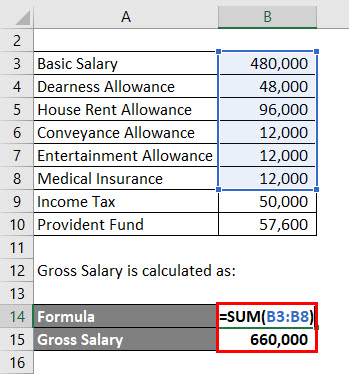

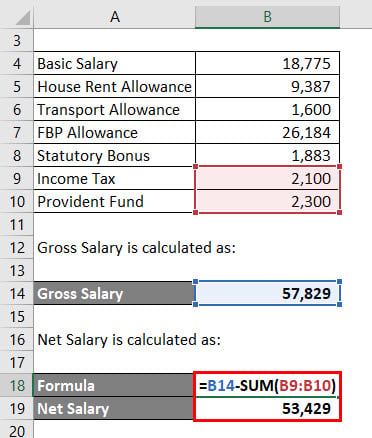

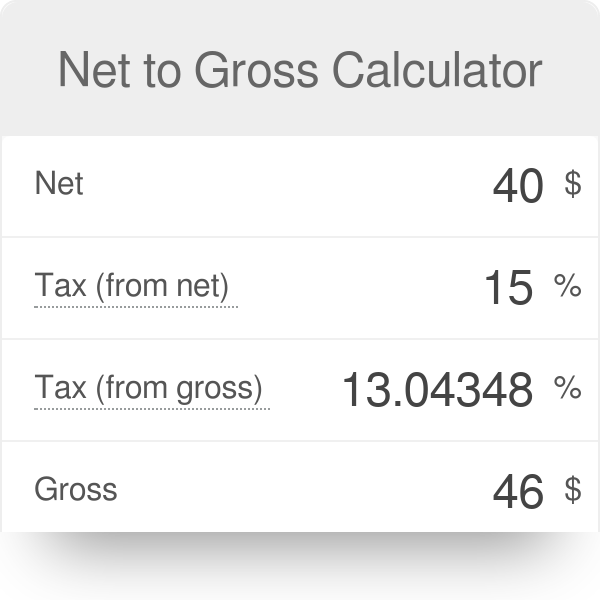

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Uk Vat Calculator Vat Calculation United Kingdom 2019 Social Value Added Tax What Are Values

Vat Calculator Ireland Updated For 2021 Tax Rates

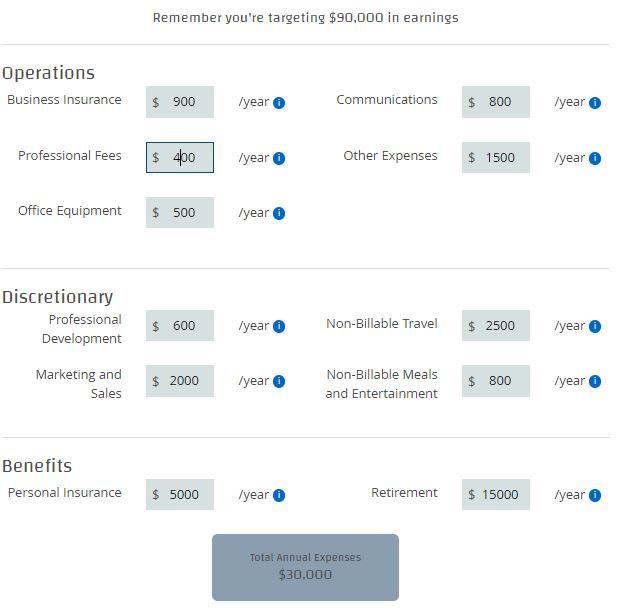

What Is Gross Vs Net Income Differences And How To Calculate Mbo Partners

Taxcalc Ie An Irish Income Tax Calculator

Salary Formula Calculate Salary Calculator Excel Template

Average Accountant Salary How Much Do Accountants Make Accounting Salary Http Gazettereview Com 201 Accounting Companies In Dubai Accounting And Finance

Small Business Expenses Business Budget Template Spreadsheet Business

Post a Comment for "Gross Pay Calculator Ireland"