Gross Annual Income Calculator Philippines

By May 30 2021 Uncategorised 0 comments May 30 2021 Uncategorised 0 comments. Gross annual income calculator philippines.

Shop Planner Business Planner Etsy Seller Planner Small Business Etsy Business Business Printable Business Goals Business Planner Small Business Organization Business Planning

See how we can help improve your knowledge of Math Physics Tax Engineering and more.

Gross annual income calculator philippines. Gross annual income calculator philippines. Procedures for Availment of Tax Subsidy of GOCCs. Gross annual income calculator philippines.

Generally its the amount of income thats taxable unless exempted by law. The most typical earning is 335513 PHP. Capital gain on sale of shares of PHP 5000.

Some money from your salary goes to a pension savings account insurance and other taxes. May 30 2021 By In Uncategorized. Highlights of the FIRB Accomplishment Report CY 2014.

We are continuously working with Certified Public Accountants when making changes to this app. Net Of Tax Definition. Ang tax calculator na ito ay pawang para sa mga sumasahod lamang dahil sa ibang sistema ng pababayad ng buwis para sa mga self-employed at propesyunal tulad ng mga doktor.

Gross dividend income from investment in shares of stock of a domestic corporation of PHP 10000. Sweldong Pinoy is for personal use. Taxable income is your total annual income minus all the deductions and tax reliefs you are entitled for.

Excel Formula Basic Overtime Calculation Formula Exceljet. Interest of PHP 20000 on peso bank account. One of a suite of free online calculators provided by the team at iCalculator.

Annual net income calculator. This is done by raising the minimum taxable income. How To Calculate Gross Annual Income Philippines DOWNLOAD IMAGE.

Enter either your gross hourly wage into the first field or your gross annual income into the fourth field. There are two ways to determine your yearly net income. Based on the Republic Act RA 10963 the Act which is known as the Tax Reform for Acceleration and Inclusion or the so-called TRAIN the accompanying tax rates will be applied for annual or yearly income tax for every Filipino citizen.

Notice the selling expenses admin expenses and taxes are not taken into account. Comprehensive Guide To Payroll Salary Compensation Benefits And. Net income is the money after taxation.

May 30 2021 in Informació general. Gross annual income calculator philippines. Taxes withheld by employer of husband at PHP 118000 and by employer of wife at nil.

Free Shipping on orders over US3999 How to make these links. We created this to allow individuals to have an idea on how much their net pay would be. Husband PHP Wife PHP Gross income.

Income Tax is a tax on a persons income emoluments profits arising from property practice of profession conduct of trade or business or on the pertinent items of gross income specified in the Tax Code of 1997 Tax Code as amended less the deductions if any authorized for such types of income by the Tax Code as. All data are based on 3087 salary surveys. En 30 mayo 2021 30 mayo 2021 por Deja un comentario en gross annual income calculator philippines.

Magnitude of Tax Subsidy Grant and Utilization By Recipient 2006-2015. Please do not use the app as a replacement. Review the latest Philippinesese income tax rates and thresholds to allow calculation of salary after tax when factoring in health insurance contributions pension contributions and other salary taxes in Philippines.

Set the net hourly rate in the net salary section. Look into the income tax table and determine your salary column. Gross annual income calculator philippines.

Average Salary Philippines Average salary in Philippines is 856997 PHP per year. Gross annual income calculator philippines. Maaring magbayad ang mga propesyunal na kumukita ng 3 milyon pababa ng 8 na buwis sa lahat ng kabayarang siningil ng propsesyunal sa halip na magbayad ng personal income tax at percentage tax.

Taxable Income Monthly Salary - Total Deductions 25000 - 1600 23400 Base on our sample computation if you are earning 25000month your taxable income would be 23400. With the new tax reform middle and low income earners will be exempted from income tax. Husband is occupying a managerial position in the company.

Gross salary is however inclusive of bonuses overtime pay holiday.

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Book Value Can Mean Various Things To Various People For Instance Book Value On The Invest Pedia Blog At Meant To Be Intangible Asset Credit Card Statement

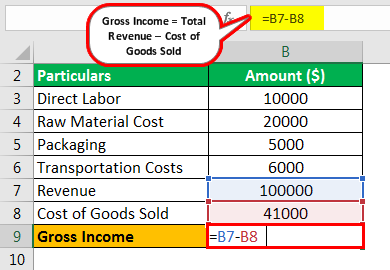

Gross Income Formula Step By Step Calculations

The Complete Guide To Bookkeeping For Small Business Owners Small Business Finance Small Business Organization Bookkeeping Business

The Captivating How To Analyze Non Profit Financial Statements And Non Pertaining To Financial Statement Templates Profit And Loss Statement Statement Template

How To Create An Income Tax Calculator In Excel Youtube

Calculating Gross Pay Worksheet Home Amortization Spreadsheet Watchi This Before You Apply Your First Va Loan Student Loan Repayment Spreadsheet Worksheets

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

Gross Income Formula Step By Step Calculations

0369ae03 8998 478d 8581 D89e12b7d9c3 Learn English Vocabulary Learn English Words English Grammar

Sample Financial Reports Report Templates Annual For School Example Within Quarterly Re Income Statement Profit And Loss Statement Personal Financial Statement

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

2021 Philippine Income Tax Tables Under Train Pinoy Money Talk

Alarm Certificate For Insurance Template Luxury Insurance Policy Verification Letter In 2019 Dannybarrantes Lettering Insurance Template Certificate Template

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Annual Income Learn How To Calculate Total Annual Income

Post a Comment for "Gross Annual Income Calculator Philippines"