Annual Income Calculator Uk

Net to Gross Salary Calculator At Stafftax we strongly advocate discussing and agreeing salaries in gross terms. The other 2 weeks are vacation.

25 000 After Tax Salary Calculator Uk

Next determine any additional.

Annual income calculator uk. How to use the Take-Home Calculator. 40000 x 12 4800. Find out the benefit of that overtime.

11 income tax and related need-to-knows. The annual net income calculator will display the result in the last field. Half of the population earns less than this figure and only those people who are required to pay income.

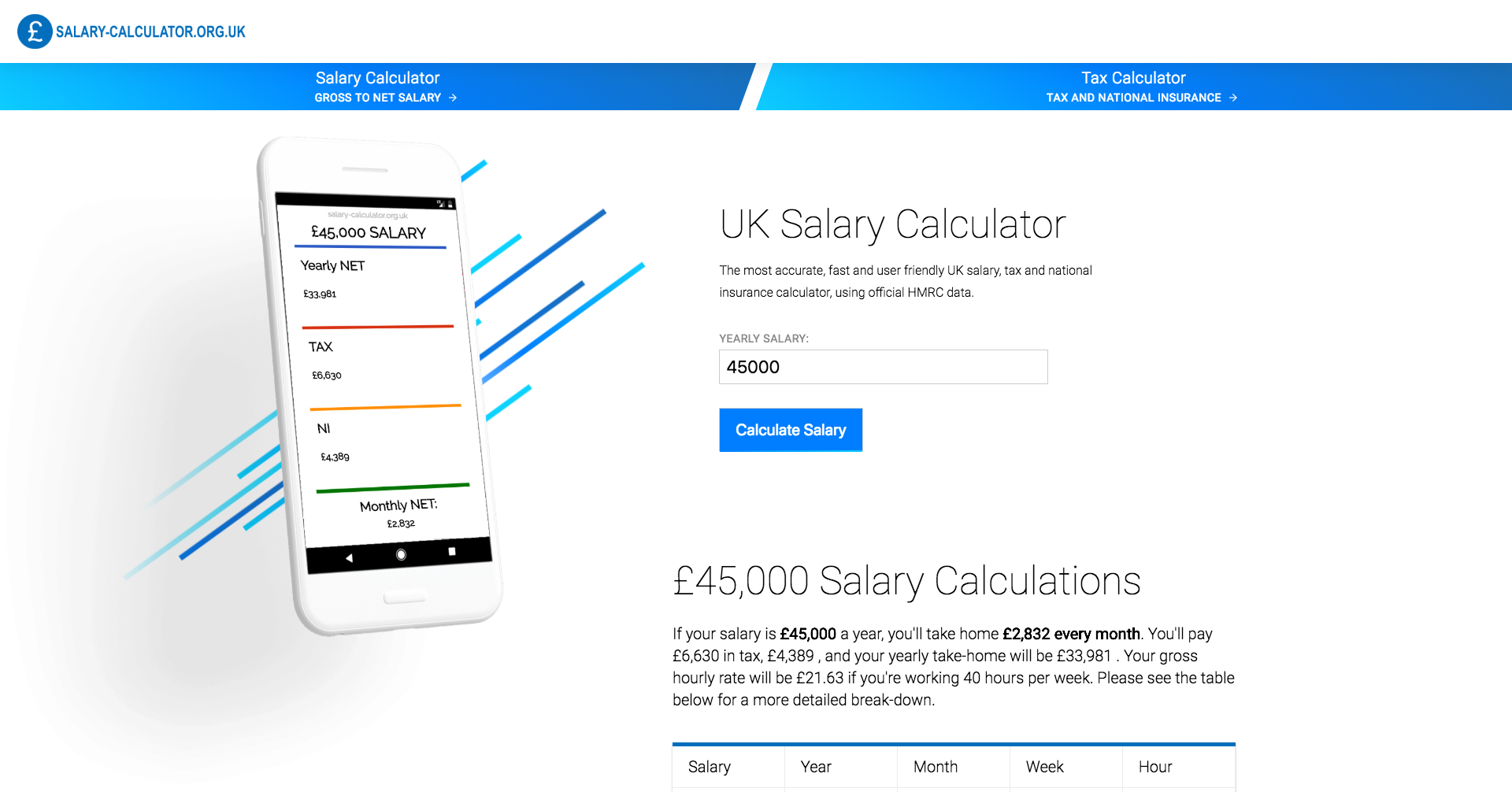

If you have benefits in kind you can enter two different BIK value sot compare the differences too. Thank you for using our salary calculator. Youll be able to see the gross salary taxable amount tax national insurance and student loan repayments on annual monthly weekly and daily bases.

To calculate your salary simply enter your gross income in the box below the GROSS INCOME heading select your income period default is set to yearly and press the Calculate button. See our article covering the interaction of tax relief and annual allowance. London and Cambridge are the places where the highest average wages have been reported in 2018.

Use the calculator to work out an approximate gross wage from what your employee wants to take home. See how we can help improve your knowledge of Math Physics Tax Engineering and more. Your working time will include days per week hours per day and weeks per year.

The average UK salary in 2018 is 30500 for men and 25200 for women. The 20162017 net salary tax calculator page. Free tax code calculator Transfer unused allowance to your spouse.

The highest salaries in the UK are in the financial services and in the IT industry. An easy to use yet advanced salary calculator at your fingertips. To determine her annual income multiply all the values.

40000 x 6 2400. Susanne earns 15 per hour and works full time 40 hours per week 52 weeks a year. Marriage tax allowance Reduce tax if you wearwore a uniform.

The Annual tax calculator is a comprehensive calculator for salary income tax dividends overtime pay rise and payroll calculations online. Relief at Source RAS contribution. How to find annual income - examples.

To accurately calculate your salary after tax enter your gross wage your salary before any tax or deductions are applied and select any conditions which may apply to yourself. Updated with the platest UK personal income tax rates and thresholds for 2021. 150 08 to gross it up x 12 2250.

The results are broken down into yearly monthly weekly daily and hourly wages. Why not find your dream salary too. To use the tax calculator enter your annual salary or the one you would like in the salary box above.

The 20202021 UK Real Living Wage is currently 1075 in London and 930 elsewhere. Between 50271 and 150000 youll pay at 40 known as the higher rate and above 150000 youll pay 45 the additional rate. Use SalaryBots salary calculator to work out tax deductions and allowances on your wage.

This equates to an annual salary of 29900 annually although it should be noted that this figure represents the income of a household not an individual. Just enter your salary. 15 40 52 31200.

What is the Average UK Income. Estimate how much Income Tax and National Insurance you can expect to pay for the current tax year 6 April 2021 to 5 April 2022 Skip to main content. If you have vacation pay for these days enter your weeks as the full 52 weeks.

On average the number of weeks worked per year is around 50 weeks. This is very useful is you are wondering what the difference a pay rise will make - or comparing salaries from two jobs. 3X higher 1X lower earner.

Check your tax code - you may be owed 1000s. Button and the table on the right will display the information you requested from the tax calculator. One of a suite of free online calculators provided by the team at iCalculator.

How to calculate annual income from hourly. If youre still curious about how our yearly salary calculator works here are two examples showing it in practice. The median monthly household income in the United Kingdom is 2491 before deductions such as income tax and National Insurance payments have been made.

Enter the number of hours and the rate at which you will get. The Annual Salary Calculator is updated with the latest income tax rates in United Kingdom for 2021 and is a great calculator for working out your income tax and salary after tax based on Annual income. Tax-free childcare Take home over 500mth.

The Salary Calculator tells you monthly take-home or annual earnings considering UK Tax National Insurance and Student Loan. The calculator is designed to be used online with mobile desktop and tablet devices. This is based on Income Tax National Insurance and Student Loan information from April 2021.

872 if over 25 820 21-24 years old 645 18-20 years old 455 for under 18 years old and 415 for apprentice. Enter the net wage per week or per month and you will see the gross wage per week per month and per annum appear. Hourly rates weekly pay and bonuses are also catered for.

The latest budget information from April 2021 is used to show you exactly what you need to know. You can also optionally enter a second gross salary to compare against the first. If you are earning a bonus payment one month enter the value of the bonus into the bonus box for a side-by-side comparison of a normal month and a bonus month.

First determine your hourly pay rate and working time. Note that your personal allowance decreases by. Uniform tax rebate Up to 2000yr free per child to help with childcare costs.

The 20202021 UK minimum wage National Living Wage per hour is currently. On income between 12571 and 50270 youll pay income tax at 20 - known as the basic rate.

Hourly Salary Calculator Uk How To Work It Out And What It Means The Progression Playbook

Uk Tax Calculator 2015 2014 2013 Salary Calculator 2013 Listentotaxman Paye Income Tax Calculator Payslip How Calculator Ideas Salary Calculator Repayment

How To Calculate Income Tax In Excel

Full Time Annual Salary In The Uk 2020 By Age And Gender Statista

How To Calculate Foreigner S Income Tax In China China Admissions

50 000 After Tax 2021 Income Tax Uk

Income Tax Calculator Calculate Income Tax Online Fy 2020 21

Coding Salaries In 2019 Updating The Stack Overflow Salary Calculator Stack Overflow Blog

Tax On Bonus How Much Do You Take Home Uk Tax Calculators

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Payroll Template Salary

Net Salary Calculator Templates 13 Free Docs Xlsx Pdf Salary Calculator Salary Calculator

Comparison Of Uk And Usa Take Home The Salary Calculator

Comparison Of Uk And Usa Take Home The Salary Calculator

Post a Comment for "Annual Income Calculator Uk"