Gross Earnings Meaning Business

GROSS EARNINGS - US. This is then presented as a percentage.

Gross Vs Net Learn The Difference Between Gross Vs Net

While similar these two forms both have some stark differences that risk managers and their advisers.

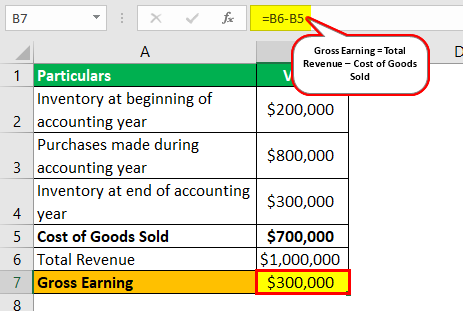

Gross earnings meaning business. Viele übersetzte Beispielsätze mit gross earnings Deutsch-Englisch Wörterbuch und Suchmaschine für Millionen von Deutsch-Übersetzungen. Gross earnings meaning in Law Dictionary. For a nonmanufacturer gross earnings are essentially total sales less the cost of goods sold.

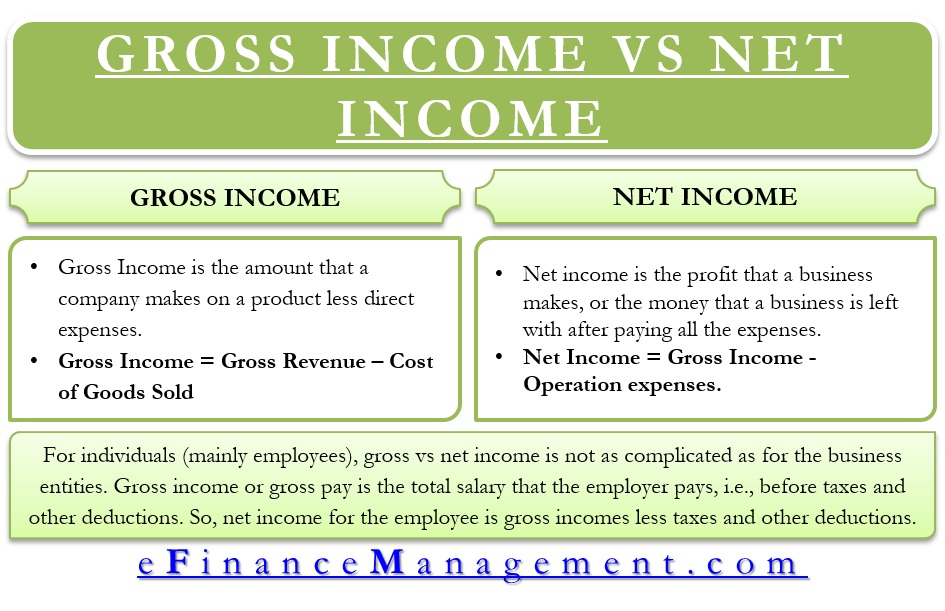

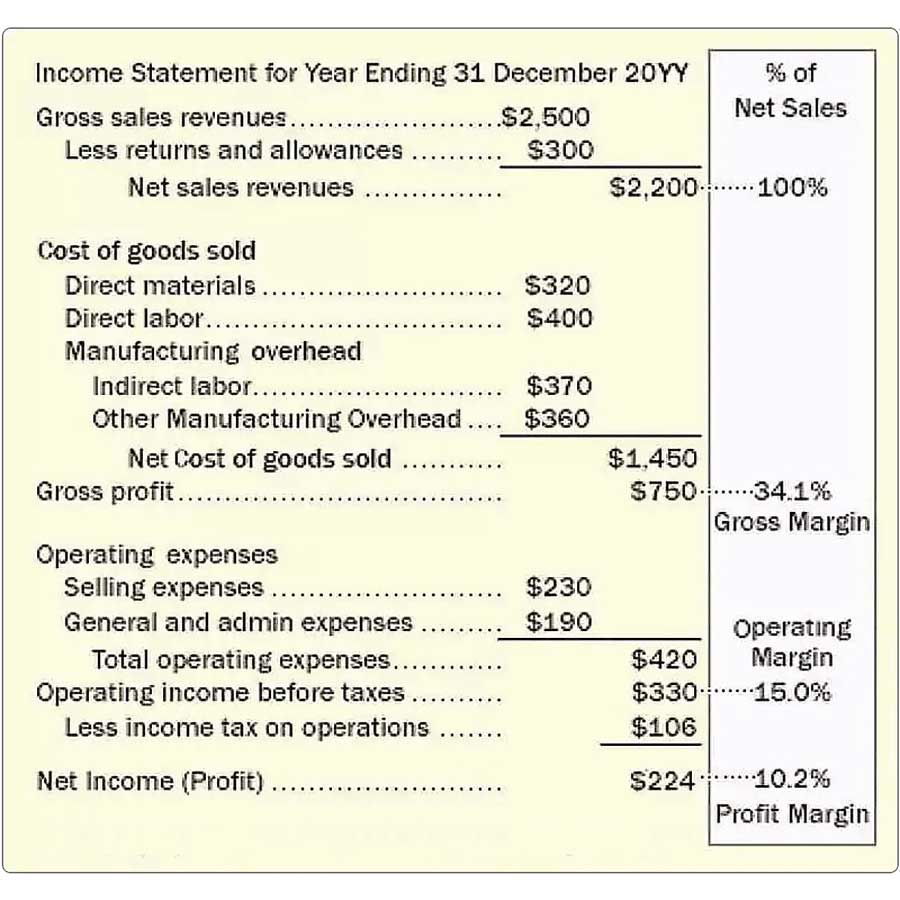

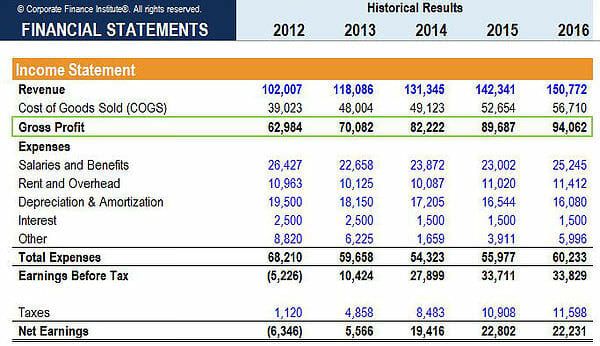

It is calculated on a business tax return as the total business sales less cost of goods sold COGS and appears on the income profit and loss statement as a starting figure. This guide will compare gross vs net in a business financial context. Law Dictionary 1 Business Dictionary 1 Support.

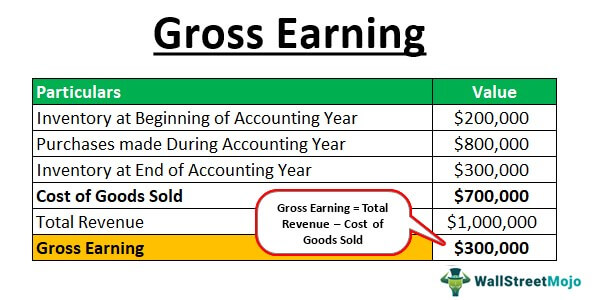

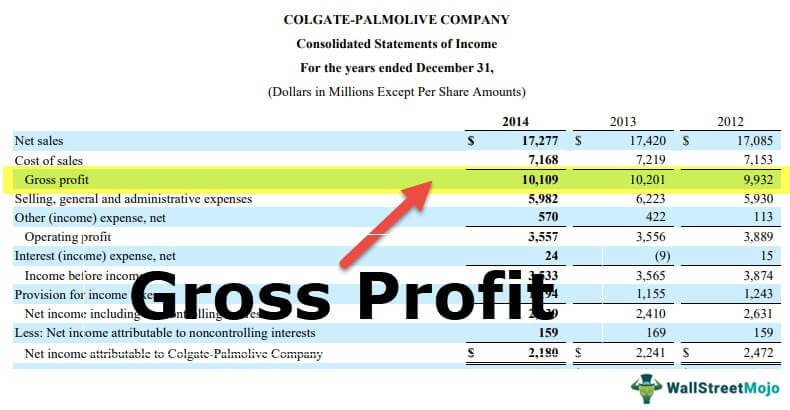

Gross profit also known as gross income or pre-tax earnings equals a companys revenues minus its cost of goods sold. Gross earnings of the company refer to the amount left over out of the total revenue generated by the company from the sale of its goods during a particular accounting period after deducting the cost of the goods sold but before deducting the other expenses taxes and the adjustments incurred by the company during that period. For example an employee has 100000 of gross earnings after which 35000 is deducted for income ta.

For example a company with revenues of 10 million and expenses of 8 million reports a gross income of 10 million. In the accounting world gross earnings are usually the same thing as gross profit that is revenue minus cost of goods sold. Gross earnings refers to the total earnings of an individual prior to deductions for income taxes and other taxes as well as any deductions imposed by the employer.

It is typically used to evaluate how efficiently a company is managing labor. Gross earnings - Deutsch-Übersetzung Linguee Wörterbuch. In a company it is calculated as revenues minus expenses.

Gross earnings meaning in Business Dictionary. A gross sum of money is the total amount before any tax or costs have been taken away net a gross profit of 5 million gross incomesalarypay etc a family with gross earnings of just 75 per week b TM TOTAL. Gross Earnings Coverage a type of business interruption insurance covering the insureds reduction in gross earnings suffered as a result of a direct damage loss.

Un-adjusted complete calculated functional income. If you did not found a. I of gross earnings as defined by regulation or prescribed amounts that are functions of gross earnings as so defined for any purpose for which insurable earnings maximum insurable earnings or weekly insurable earnings are relevant to the operation of this Act or.

An individuals gross income is important to determining eligibility for certain social programs while a companys gross income is one measure among many of how well it uses its resources to produce a profit. For the purposes of calculating payments for holidays and leave gross earnings means all payments that the employer is required to pay to the employee under the employees employment agreement for the period during which the earnings are being assessed. Gross earnings also known as gross income represents income before taxes or adjustments.

If all of the components of gross earnings are not included in the relevant calculations for holidays and leave the employee will. For a manufacturer gross earnings are the sales value of production less. Understanding the impact on your business.

Gross means the total or whole amount of something whereas net means what remains from the whole after certain deductions are made. For example if you were to buy 1000 worth of clothing and sell it for 2000 in one week your gross. Gross1 ɡrəʊs ɡroʊs S3 adjective 1 total only before noun a BF TOTAL.

However perhaps more usefully it can be used to calculate your gross profit margins. Gross business income is the total income a business receives before any taxes expenses adjustments exemptions or deductions are taken out. A calculation of a businesss revenue from company businesses before deducting associated expenditures.

As stated previously gross profit is a tool that can be used to analyse the overall profitability of your business. Gross profit margins are calculated by dividing your gross profit by your revenue. Business Interruption BI insurance is often misunderstood partly because there is a fear of the unknown but also because this type of insurance differs throughout the world.

There are essentially two dominant forms of cover known as the UK form and the US form.

Difference Between Gross Income Vs Net Income Definitions Importance

:max_bytes(150000):strip_icc()/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

Margins Measure Business Profitability And Reveal Leverage

Gross Earning Meaning How To Calculate Gross Earning

What Are Gross Wages Definition And Overview

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

Gross Vs Net Income Importance Differences And More In 2021 Bookkeeping Business Accounting And Finance Finance Investing

What Is Gross Income For A Business

Gross Earning Meaning How To Calculate Gross Earning

Gross Vs Net Pay What S The Difference Between Gross And Net Income Ask Gusto

The Difference Between Gross And Net Pay Economics Help

How Do Earnings And Revenue Differ

Operating Income Vs Gross Profit

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Gross Profit Definition Examples How To Interpret

:max_bytes(150000):strip_icc()/Howdogrossprofitandnetincomediffer2-962e065a0ae84e52b083fff305afaa96.png)

Gross Profit Vs Net Income What S The Difference

Gross Profit Essentials You Need To Know About Gross Profit

What Is Gross Income Business Gross Income Individual Gross Income Mageplaza

Post a Comment for "Gross Earnings Meaning Business"